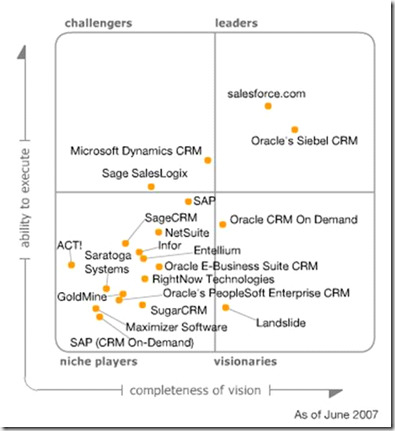

Back in April this year I did the ‘Forrester Trajectories of CRM Solutions’ which examined past Forrester reports for CRM in the mid-market and enterprise markets. At the time I struggled to find the Gartner equivalents. With the recent release of Gartner’s Magic Quadrant Report for Sales Force Automation (http://www.crm-guidebooks.com/2011/07/gartner-magic-quadrant-sales-force-automation-july-2011/) I thought I would see if, with the combined power of Google and Bing, I could turn up the quadrants this time around.

In fact I found the past five years of quadrants. Here they are:

To Those That Have Fallen, We Salute You

Just like the Oscars I would like to take a moment to remember those products that did not make the 2011 Magic Quadrant. Since 2010 we have lost (cue sentimental piano music…):

- Cegedim Dendrite (although 2010 was the only year they made an appearance)

- FrontRange Solutions (GoldMine): located in the ‘niche players’ in the previous four years, they are no longer on the quadrant

- Maximizer Software: another niche player that is no longer on the Gartner radar

- Landslide: A ‘visionary’ that had slipped into ‘niche’ last year and unfortunately has fallen off the chart this year

In previous years we also lost off the Gartner quadrant:

- Infor: last seen as a niche player in 2008

- Consona: made a once-only appearance in 2008

- Saratoga Systems: acquired by CDC in 2007, it fell off the radar in 2008

- Entellium: the company filed for bankruptcy in 2009, bought out by Intuit

- RightNow Technologies: last seen on the Gartner quadrant in 2007

New Contenders

The only new players to make the quadrant are Microsoft Dynamics CRM Online (the online version of the incumbent on-premise solution) and Zoho (http://www.zoho.com). Zoho is an online applications player based out of India (think of them as a budget Google apps). I have been watching Zoho for a while and, if you are in the market for a basic sales force automation solution, and want other applications like invoicing, simple accounting etc. it is worth looking at. A well deserved addition to the quadrant.

Overall Trends

In the Forrester trajectory post I observed a general trend towards the top right, suggesting all products were improving. This is not as obvious in the Gartner trajectories but what can be seen is a consolidation of products. Counting the number of products in the quadrant over the years we have:

- 2007: 20

- 2008: 16

- 2009: 14

- 2010: 15

- 2011: 13

This can also be seen in the number of companies in the quadrant:

- 2007: 13

- 2008: 13

- 2009: 11

- 2010: 12

- 2011: 9

In both cases the market has shrunk, in terms of participants, by about 1/3.

The movement of CRM products to the cloud will only, in my opinion, speed this consolidation up. The fact is, for small and medium-sized businesses, with minimal internal IT infrastructure, a cloud CRM offering is very compelling and very affordable. While there will likely always be a market for on-premise deployments (for example in regions with unreliable internet connections) the option of the cloud is becoming more and more acceptable for many organisations. Companies which choose not to offer cloud versions of their products will become more specialised, niche players or fade away.

Also, the barriers are high for new offerings. The combination of low price (and therefore low relative annual turnover) combined with the feature-rich nature of the incumbent products make it very difficult for a new contender to invest on building a competitive product knowing their return on investment will take a significant amount of time.

The future is likely to be dominated by cloud and cloud/on-premise offerings by a small collection of players already in the market.

Individual Product Movements

The products in the Gartner quadrant appear to be a lot more stable than their Forrester counterparts. Significant movements are:

- Microsoft Dynamics CRM has migrated from a ‘challenger’ to a ‘leader’

- Oracle CRM On Demand has moved from a ‘visionary’ to a ‘leader’

- SAP has moved from a ‘niche’ to a ‘challenger’

The good news here is nothing appears to be moving backwards; two major players are now considered leaders in the industry and another is potentially improving. The stagnation of Oracle and the rise of the some of the niche players, such as SugarCRM, Pivotal and SageCRM, seen in the Forrester reports, is not seen in the Gartner reports.

Conclusions

Reviewing the Gartner reports it appears the sales force automation market is consolidating, probably due to the move to the cloud; a trend that will likely continue. While difficult for new contenders to enter the market, Zoho has made an appearance and it will be interesting to see how they fare in future reports.

The one consistency between the two sets of reports is the rise of Microsoft Dynamics CRM. While Forrester considers Microsoft Dynamics CRM the market leader, Gartner still sees salesforce.com as the player to beat. The battle between these two giants is great for consumers as both will work harder to produce the dominant product. It is a great time to be in the CRM industry and I eagerly await future Forrester and Gartner reports to see how the battle plays out.

No comments:

Post a Comment