Something surprised me this week. Azure was awarded the Best Cloud Platform at the Cloud World Series Awards. Initially I thought this was some kind of Microsoft conference but not the case. The Cloud World Forum has sponsors from all disciplines, including Google, Amazon and Salesforce.

This surprised me, not because of personal experience with Azure, but because I had thought Azure was another Microsoft fast follower, still catching up with the competition. Perhaps Microsoft Azure was not longer following but was now edging ahead.

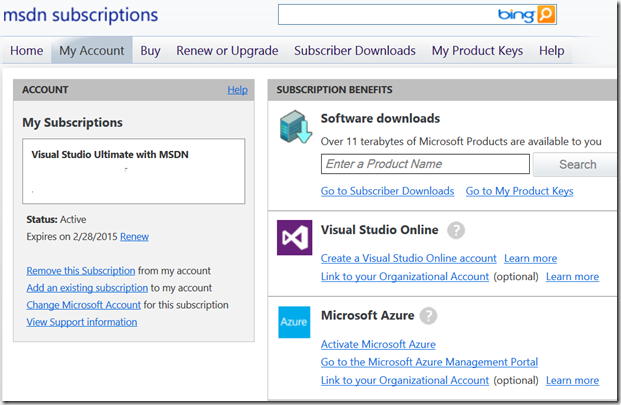

Coincidentally, I had recently decided to test the water with Azure, thanks to my MSDN subscription which gives me $160 of Azure credit per month to play with. I thought I would share my experience of using Azure in case, like me, you are also Azure-curious but anxious about what is involved.

Starting Up Azure

If you have an MSDN subscription, you can activate Azure, and go to the Azure management portal, directly from the ‘My Account’ page. No credit card needed; the service simply turns off when you run out of credit.

If you do not have an MSDN account, you can still start a trial with Azure from the Microsoft Azure site. You get a month and $200 of credit to play with (which is plenty).

Managing Azure

Azure management is done through the Azure Management Portal, which is crazy simple to use. I literally had a machine up and running in minutes.

You give it a name, assign an OS (including Linux flavors such as SUSE, Ubuntu and Oracle), the machine size and what region you want the machine to run in. Then you click ‘Create’ and a few minutes later you have your box, ready to go.

To access it, the management portal also gives you a remote desktop connection (RDP) file. Once in, you have nothing else to do other than install software and browse the net.

IP Confusion

One niggle I did have was the IP number allocated to my box was coming up as Brazil on IP Geolocation, even though I had specified the West US coast. I spun up another machine on the east coast and got the same behaviour.

A bit of browsing revealed that Microsoft recently bought a bunch of Brazilian IP addresses and many of the IP Geolocation services were still playing catch-up on the re-allocation.

Cost

For my simple purposes, the $160 was plenty to get a feel for the service. You only pay for the server while it is running so it was simple to spin it up during my lunch break, have a play and then shut it down again.

As you can see, I was spending about 6c per hour on compute time and a little less than 10c per Gig of transfer. With the $160 credit, I was in no chance of hitting my limits.

Internet Speed

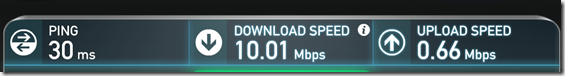

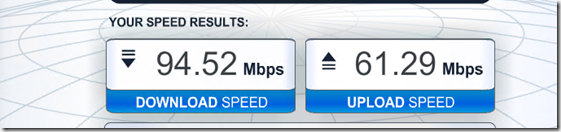

The speed I got from the box, compared to my home box was massive. At home I have ADSL2+ and here are my internet speed test results (welcome to Australia).

Compared to the Azure box

So Azure is about ten times quicker on the download and about 100 times quicker on the upload. If I need to get files quickly, the Azure box is the way to go. In fact, with my OneDrive (formerly SkyDrive) I can download files into the OneDrive folder on my Azure server, access them either on the server or via my OneDrive account and also have them eventually automatically sync to all my other important locations.

To test it, I tried downloading a movie file (nothing dodgy I promise). The file came down in seconds and within a minute it was available on my OneDrive where I could stream it on my local machine. An hour or so later the OneDrive sync had also brought the file down to my local machine.

More Than Just Servers

Azure offers a lot more than just virtual boxes. For example, I often have to spin up a CRM portal demonstration and Azure provides a great way for my developers to spin up a web site and configure it, as required. Here is the menu of ‘stuff’ available on Azure.

Conclusions

Before I took the leap, I thought that setting up a machine on Azure would be a complicated process involving network configuration, OS installing and other complicated processes best left to network administrators. While I am sure in some more complicated scenarios (such as getting the Azure box to talk to other boxes) some of this is necessary, for simply dipping a toe in the water, the process was easier than setting up a new laptop.

If you are Azure-curious I urge you to try it out from an MSDN account or give the trial a go. You can then judge whether Azure is the Best Cloud Platform on the market (I am certainly thinking it is one of the easiest for spinning up a virtual machine).