So this is my third consecutive post on Salesforce. I promise the next will be Dynamics CRM or something non-Salesforce at the very least.

For avid readers of the blog, you will know that every quarter I review the quarterly submissions of Salesforce to the Securities and Exchange Commission (SEC). Up until January 2011 this included the subscription numbers but a sad thing happened after this date; Salesforce no longer released their subscriber numbers. After July 2011 they also stopped releasing their customer numbers. There was no explanation, the numbers just stopped coming. Here are the data we have from Salesforce’s public statements up to these dates.

| Financial Quarter | Month | Subscribers | Customers | Average Company Size |

| 2003 Q4 | Jan-03 | 76,000 | 5,700 | 13 |

| 2004 Q1 | Apr-03 | 85,000 | 6,300 | 13 |

| 2004 Q2 | Jul-03 | 96,000 | 7,000 | 14 |

| 2004 Q3 | Oct-03 | 107,000 | 7,700 | 14 |

| 2004 Q4 | Jan-04 | 127,000 | 8,700 | 15 |

| 2005 Q1 | Apr-04 | 147,000 | 9,800 | 15 |

| 2005 Q2 | Jul-04 | 168,000 | 11,100 | 15 |

| 2005 Q3 | Oct-04 | 195,000 | 12,500 | 16 |

| 2005 Q4 | Jan-05 | 227,000 | 13,900 | 16 |

| 2006 Q1 | Apr-05 | 267,000 | 15,500 | 17 |

| 2006 Q2 | Jul-05 | 307,000 | 16,900 | 18 |

| 2006 Q3 | Oct-05 | 347,000 | 18,700 | 19 |

| 2006 Q4 | Jan-06 | 393,000 | 20,500 | 19 |

| 2007 Q1 | Apr-06 | 438,000 | 22,700 | 19 |

| 2007 Q2 | Jul-06 | 495,000 | 24,800 | 20 |

| 2007 Q3 | Oct-06 | 556,000 | 27,100 | 21 |

| 2007 Q4 | Jan-07 | 646,000 | 29,800 | 22 |

| 2008 Q1 | Apr-07 | 742,900 | 32,300 | 23 |

| 2008 Q2 | Jul-07 | 800,000 | 35,300 | 23 |

| 2008 Q3 | Oct-07 | 952,500 | 38,100 | 25 |

| 2008 Q4 | Jan-08 | 1,100,000 | 41,000 | 27 |

| 2009 Q1 | Apr-08 | 1,177,200 | 43,600 | 27 |

| 2009 Q2 | Jul-08 | 1,287,900 | 47,700 | 27 |

| 2009 Q3 | Oct-08 | 1,398,600 | 51,800 | 27 |

| 2009 Q4 | Jan-09 | 1,500,000 | 55,400 | 27 |

| 2010 Q1 | Apr-09 | 1,660,400 | 59,300 | 28 |

| 2010 Q2 | Jul-09 | 1,769,600 | 63,200 | 28 |

| 2010 Q3 | Oct-09 | 2,000,000 | 67,900 | 29 |

| 2010 Q4 | Jan-10 | 2,102,500 | 72,500 | 29 |

| 2011 Q1 | Apr-10 | 2,319,000 | 77,300 | 30 |

| 2011 Q2 | Jul-10 | 2,554,400 | 82,400 | 31 |

| 2011 Q3 | Oct-10 | 2,790,400 | 87,200 | 32 |

| 2011 Q4 | Jan-11 | 3,000,000 | 92,300 | 33 |

| 2012 Q1 | Apr-11 | 3,321,800 | 97,700 | 34 |

| 2012 Q2 | Jul-11 | 3,640,000 | 104,000 | 35 |

The numbers in red are my best guess, based on the known numbers.

So is there anything else we can use to indirectly infer the subscription numbers?

My Old Idea

Up until this blog, my proxy for the subscription numbers had been Revenue which is still reported every quarter. Essentially I assume the average revenue per subscriber per month and then use this to derive a subscriber count. Generally I pick the revenue PUPM to be around $50 which, for the latest quarterly report, gives us a subscriber count of a little over 8 million subscribers and, assuming the average size of a Salesforce customer is 35 users, this gives us a total of 230,000 customers.

The above estimates rely heavily on my guess for the revenue PUPM and the average Salesforce customer size. While consistent with known historical values, they are still a speculation. There turns out to be a better way.

Daily Transaction Numbers

A couple of years ago, Ross Dembecki (Silverpop/Core Motives/CWR guru and seriously nice bloke) sent me a message suggesting that, if I was interested in Salesforce’s growth, to consider monitoring their daily transaction levels, as published on their ‘trust’ page. It turns out Ross was on the money and it has only taken me two years to catch up. By scouring the internet and using this article, we get quite a few data points for Salesforce’s historic transaction levels.

| Date | Transactions |

| 28/09/2006 | 53,000,000 |

| 09/10/2007 | 117,000,000 |

| 2009 | 150,000,000 |

| 20/05/2009 | 195,000,000 |

| 10/11/2010 | 394,000,000 |

| 11/2011 | 500,000,000 |

| 17/11/2011 | 623,000,000 |

| 11/2012 | 1,000,000,000 |

| 08/2013 | 1,300,000,000 |

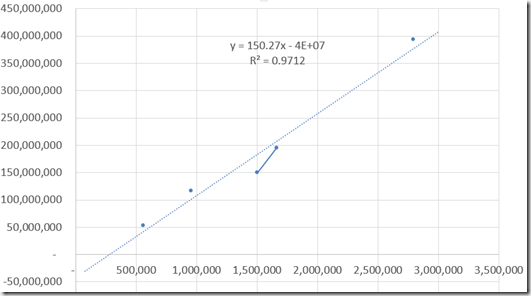

Plotting the transactions against the known subscriber levels gives us this.

The x-axis is the number of subscribers and the y-axis is the number of transactions.The “R-squared value” tells us how related the two sets of data are. In this case, there is a 97% match, suggesting the two are very correlated.

What is more, the equation of the closest fitting line (y=150.27x-40,000,000) tells us that for each subscriber that comes on board, the daily transaction count goes up by about 150.

Doing the same for the customer numbers gives us this:

Predictions From the Graph

We know that in August 2013, there were 1.3 billion transactions. Using our linear equation, this suggests that in August 2013, Salesforce had just shy of 9 million subscribers. Looking at the trust site, Salesforce is on the cusp of a 2 billion transaction day, which puts subscribers at around 13.5 million. In terms of customers, we get about 383,000 customers.

This is a lot more that the 8 million subscribers I predicted via the revenue which means one of my assumptions is wrong e.g. my predicted revenue PUPM is too high. In fact, at 13.5 million subscribers, the revenue per user per month is closer to $30. The numbers also predict the average customer size is 35, about one third of the average customer size of Dynamics CRM (4,000,000/40,000 = 100). This average company size is consistent with the known numbers where the last known average company size of 33 (and increasing). Also, the $30 revenue prediction is consistent with the known numbers where the last known value was $51 and falling.

Conclusions

Unless Salesforce release actual numbers, all of this is speculation but, using the transactions seems to be the best approach with minimal assumptions. The numbers predicted are consistent with the known data and their trends from three years ago. While the transaction numbers predict a very large subscription base (three to four times that of Dynamics CRM), if they are correct, Salesforce make a surprisingly small revenue from their subscribers and the average size of the companies using Salesforce is also surprisingly small.

2 comments:

I'm making an assumption that a transaction equals a CRUD action (Create, Read, Update, Delete). Based on that assumption, I'm wondering if other factors play into the transaction numbers like power users, integrations......

It is difficult to know the composition of the transaction count; I am unaware of a formal definition. There does appear to be a strong correlation between the transaction numbers and the subscribers/customers for the first five years though.

The assumption in my analysis is that this correlation remains today.

Post a Comment