I was watching Hans Rosling the other day do what he does best with his gapminder software. That is, dispelling myths and making volumes of data speak volumes through visualisation. If you don’t know Hans, here is an example of him at work.

It occurred to me that the little dancing circles were not dissimilar to the Gartner quadrant and Forrester Wave pictures those of us in the IT game are used to. I figured that while I did not have a few hundred years of data, even with a few years of information I may be able to extract some interesting conclusions.

If you are interested in seeing the research, a good place to begin is the Microsoft Analyst Relations Reports. Here you will find a host of white papers and reports. Obviously, Microsoft are unlikely to link to reports which paint their products in a poor light so feel free to use your favourite search engine to supplement.

While Gartner reports were a little light on the ground, I did manage to find a good selection of Forrester Wave reports for CRM suites in the mid-market and enterprise-market on the Microsoft page and supplemented this with another I found online (http://www.ibizinitiatives.com/ForresterCRMStudy.pdf)

Mid-market Velocities

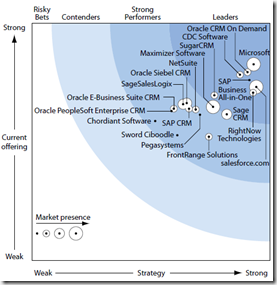

These three graphs are for 2007, 2008 and 2010 respectively. The size of the circle, if I am reading the paper correctly, is a rough measure of market share and the company’s dedicated team size to the space.

The first thing I notice is the migration to the top right corner; the leaders area. Overall, solutions are generally improving.

In terms of individual products, let’s look at some of the more interesting ones.

| Solution | Observations |

| Oracle Siebel CRM Professional | This one appears to be slipping. The product to be envied in 2007-2008, they are now truly out of the Leader section, falling back to Strong Performers. Strangely, they appear to have a stronger market presence now than in the past. |

| salesforce.com | The ‘cloud Siebel’ continues to improve their product and appears to have increased their market presence in recent years |

| Microsoft Dynamics CRM | Like salesforce.com, Dynamics CRM continues to advance towards the top right corner, it has increased its market presence and is now the leader on the chart. |

| Netsuite | Although the movement is not huge, it does appear to be moving in the wrong direction. |

| Sage Saleslogix | Appears to be advancing through the Strong Performers but is yet to make a Leaders position |

| CDC Software’s Pivotal | Despite not featuring in the 2008 chart, they have rocketed from a Contender position through to Leader. |

| SugarCRM | Another little battler. The have moved through to a Leader position and have improved their market presence |

| Sage CRM | Also increasing market presence and is just in the Leader position |

| FrontRange’s Goldmine | Their market presence has gone from one of the two dominant players to one of the smallest in a span on three years. |

| Maximizer | Goldmine’s fortunes are contrasted against the other ‘big player’ in 2007, Maximizer. Maximizer has maintained its market presence and is also now in a Leader position |

Enterprise Velocities

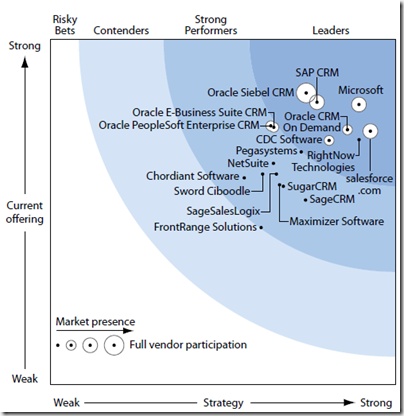

For the Forrester Wave reports, I could only find reports for 2008 and 2010

However, there are still things to observe. For example, it appears that a lot more of the, traditionally, smaller market players are now stretching into the enterprise.

As for individual products, there are also some things of note.

| Solution | Observations |

| Oracle Siebel CRM | The traditional ‘900-pound gorilla’ in the market, their strategy appears to be slipping and other players stretch up from the mid-market. They have lost their dominant position but remain a Leader. |

| SAP CRM | Suffering a similar fate to Oracle Siebel CRM, SAP also has the indignity of reducing its market presence. |

| Microsoft | Creeping up, they have now taken the dominant Leader position in the market |

| salesforce.com | Similar to Dynamics CRM, salesforce.com appears to also be sliding in front of Oracle Siebel CRM and SAP CRM |

| Oracle Peoplesoft CRM | Loss of market presence and also appears to be moving in the wrong direction, albeit slowly. |

| Oracle E-Business Suite CRM | Also losing presence and moving in the wrong direction. |

Conclusions

For those of us that remember Mosaic, MySpace and WordPerfect, we know that today’s darling is tomorrow’s forgotten software. There are some clear trends here:

- Oracle cannot seem to do anything right. Their products, which they have many, are either stagnating or going backwards, relative to their competitors

- salesforce.com and Microsoft Dynamics CRM are edging out the competition in both the mid-market and enterprise

- Players such as CDC Software’s Pivotal, SugarCRM and Sage CRM should be watched, given their trajectory

As other Wave reports come out I will update the research.

Disclaimer: As well as working extensively with Dynamics CRM, the company I work for, Praxa, is owned by the same company as CDC software.

No comments:

Post a Comment