Introduction

With the recent announcement of CRM 2011 and the suggestion that it will challenge the dominance of Salesforce, I thought it would be a good time to look at the history of the number of users of both products and how they stack up.

Salesforce

| Year | Subscribers | Customers | Average Company size |

| 2009 | 2,100,000 | 72,500 | 29 |

| 2008 | 1,500,000 | 55,400 | 27 |

| 2007 | 1,100,000 | 41,000 | 27 |

| 2006 | 646,000 | 29,800 | 22 |

| 2005 | 393,000 | 20,500 | 19 |

| 2004 | 227,000 | 13,900 | 16 |

| 2003 | 127,000 | 8,700 | 15 |

| 2002 | 76,000 | 5,700 | 13 |

| 2001 | 53,000 | 3,500 | 15 |

| 2000 | 30,000 | 1,500 | 20 |

Getting the numbers on Salesforce is pretty easy. Here are my sources:

Salesforce was launched in 1999, according to the first source, if you need a zero data point.

Microsoft Dynamics CRM

| Year | Subscribers | Customers | Average Company size |

| Jul-10 | 1,400,000 | 23,000 | 61 |

| Apr-10 | 1,100,000 | 22,000 | 50 |

| 2009 | 1,000,000 | 21,277 | 47 |

| 2008 | 500,000 | 11,000 | 45 |

| 2007 | 400,000 | 10,000 | 40 |

The company size and customers for 2009 is a guess by me as they only said they had reached 1 million subscribers (users). 47 seemed like a reasonable guess.

Getting the numbers for Dynamics CRM needed a bit more detective work. Here are the sources.

Despite being released in 2003, I struggled to find numbers pre-2007.

Things of Note

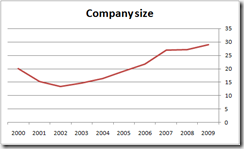

The first thing that stands out is the average customer size (subscribers/customers). The average Dynamics CRM customer is around 50% larger than its Salesforce equivalent. In both cases the average company size is growing but it is difficult to know whether this is due to both products appealing to larger companies, as they are proven in the market, or whether its simply a case of existing customers increasing the number of employees using the software.

The trend for subscribers and customers, in both cases knows no bounds, suggesting the market is far from maturing, but the average company size, in both cases, does appear to be tapering. In the case of Salesforce, the average company size appears to be approaching 30 and for Dynamics CRM 50 (although the more recent data bucks this trend).

The other thing of note is that Salesforce has a big lead on Dynamics CRM. As of 2009, Salesforce had about twice as many subscribers and three times as many customers. The gap is narrowing though. This can be seen by considering 2008 where Salesforce had three times the subscribers and five times the customers. The gap was less in 2007 (three times the subscribers and four times the customers) but still more than the current position. This suggests Dynamics CRM is catching up.

When (and if) Will Dynamics CRM catch up on Salesforce?

It is an excellent question and very difficult to answer given the rate of growth in both companies knows no bounds. However, we can speculate. Considering the percentage growth of subscribers and users, Salesforce is growing at around 50-60% year on year.

For Microsoft, the data is too patchy. Even if we include the months of release of the statements, we get a bit more data to play with but it is still difficult to get any consistency.

| Year | Subscribers | Customers | Average Company size |

| Jul-10 | 1,400,000 | 23,000 | 61 |

| Apr-10 | 1,100,000 | 22,000 | 50 |

| Jul-09 | 1,000,000 | 21,277 | 47 |

| Mar-08 | 500,000 | 11,000 | 45 |

| May-07 | 400,000 | 10,000 | 40 |

The best I could do was feed the data into Excel, assume exponential growth and see where the numbers ended up.

The graph says Salesforce will run away from Dynamics CRM. However, given factors such as a finite market size and a changing marketplace, I do not consider this a prediction by any means but it will be interesting to see if Salesforce makes 3,000,000 subscribers by October 2010 and whether Dynamics CRM will make 1,500,000 subscribers by December 2010.

What’s this about a changing marketplace?

One of the assumptions in interpreting the above graph involves the market the two products find themselves. Salesforce has been offering its service worldwide since at least 2003. Dynamics CRM has had an international version since the release of version 4 in December 2007 but a Microsoft-hosted international version is yet to be released. We now know, thanks to the worldwide partner conference, that Dynamics CRM 2011 will be released in 40 markets and 41 languages.

In other words, it can be argued that the growth of Dynamics CRM has been hampered, to date, through a lack of access to the international market which Salesforce already accesses. Alternatively, it could be argued that Salesforce has grown due to a lack of a viable competitor (assuming Dynamics CRM is one). With the release of Dynamics CRM 2011, the two products, in terms of a vendor-hosted CRM solution, will be on equal footing and then it will be easier to make growth comparisons. In fact, it could be argued that with the ‘power of choice’, Microsoft will be able to access markets inaccessible to Saleforce i.e. companies that insist on an on-premise solution.

Conclusions

There is no doubt that Salesforce has a first-mover advantage. They released their software four years before Microsoft and even then, Microsoft did not have a hostable solution until 2007. It will not be until the end of the year that Microsoft will be offering their product internationally and hosted by themselves. If we assume nothing is going to change, it is not obvious how, when, or if Dynamics CRM will catch up.

However, markets are finite, Microsoft have deep pockets, they are notorious for leveraging the ‘stack’ to sell in other Microsoft products and they will soon have a product that competes in the same market as Salesforce. If nothing else, the next 18 months should make for very interesting times.

12 comments:

I mentioned my article to my wife, who is a marketer. She suggested the difference in average company size could also be due to CRM Online only playing in the US market. An average SME in the USA is larger than, say, an average SME in Australia. If this is the case, we should see the average company size for Dynamics CRM drop and approach the Salesforce level once Dynamics CRM Online goes international.

Finally found another CRM datapoint stating Dynamics CRM had 200k users and 7k customers (average size 29) in July 21, 2006. http://webcache.googleusercontent.com/search?q=cache:9Z6vPO9Fj58J:www.managingautomation.com/maonline/news/read/Microsoft_Corp_Microsoft_Business_Solutions_Ends_Fiscal_2006_in_the_Black_21106+%22dynamics+crm%22+%22200,000+users%22&cd=10&hl=en&ct=clnk&gl=au

And another one, although they do not materially affect the article so I won't edit it. As of 20 October 2006, Dynamics CRM had 250k customers in 8k companies (ave: 31)

http://www.destinationcrm.com/Articles/News/Daily-News/Connectors-for-Dynamics-CRM-42684.aspx

I'm on a roll. As of March 2006, Dynamics CRM had 150k users in 6k companies (ave 25). http://www.microsoft.no/portfolio/Marketing_in_a_box/PPT/CRM/Microsoft%20CRM%203.0%20BDM%20Overview%20Slides%20v2.ppt

And a number for SFDC in Jun 14 2010, 77k customers http://business.asiaone.com/Business/Tech%2BSense/Highlights/Story/A1Story20100614-221969.html

Looks like I'll need to write up a follow up at this rate.

As of 5/5/2010, SFDC had 75k customers http://www.forbes.com/2010/05/05/benioff-microsoft-facebook-intelligent-technology-salesforce.html?boxes=Homepagechannels

So they added around 2k customers in one month. That translates to around 60k subscribers.

New SFDC numbers 87,200 customers http://www.crmbuyer.com/story/71282.html

New SFDC datapoint 92000 customers at 28/2/11

Dynamics CRM now at 27k customers and 1.7 million users http://microsoftaucrm.wordpress.com/2011/04/12/organisations-transform-their-businesses-with-microsoft-dynamics-crm-2011/

To be confirmed but apparently at WPC (July 2011) the numbers for Dynamics CRM were 2m subs and 30k custs

Found confirmation. http://blogs.msdn.com/b/crm/archive/2011/07/13/microsoft-dynamics-crm-at-the-2011-worldwide-partner-conference.aspx

Salesforce have updated their subscription numbers and financials http://www.sfdcstatic.com/assets/pdf/investors/Q2FY12_Salesfoce_FinancialResults.pdf

Post a Comment