Hot off the Salesforce press are the financial numbers for the full year. Did they make a quarter of a billion dollar loss like they predicted six months ago? Which prominent C-Level executive is moving on? Will Marc say the p-word (profit) and burst into flames? All will be revealed.

The Numbers

These numbers are not taken from the Salesforce detailed financials on their web site because those numbers are now one year out of date. Neither are they from the annual report as this is not yet complete. These (unaudited) numbers are from the press release associated to the full year announcement and, as usual, are the GAAP numbers.

| 2013 Q4 | 2014 Q1 | 2014 Q2 | 2014 Q3 | 2014 Q4 | 2014 TOTAL | |

| Revenue | 834,681 | 892,633 | 957,094 | 1,076,034 | 1,145,242 | 4,071,003 |

| Subscription Revenue | 785,495 | 842,221 | 902,844 | 1,004,476 | 1,075,001 | 3,824,542 |

| Revenue Cost | 183,362 | 208,994 | 217,717 | 268,187 | 273,530 | 968,428 |

| Operating Cost | 672,126 | 728,179 | 779,234 | 905,778 | 975,458 | 3,388,649 |

| Salesforce Income | -20,844 | -67,721 | 76,603 | -124,434 | -103,746 | -219,298 |

| Revenue Growth # yoy | 202,768 | 197,166 | 225,445 | 287,636 | 310,561 | |

| Revenue Growth % yoy | 32% | 28% | 31% | 36% | 37% | |

| Total Cost % yoy | 34% | 31% | 34% | 39% | 46% | |

| Staff | 9,801 | 10,283 | 12,571 | 12,770 | 13,312 | |

| Staff Growth (yoy) | 26% | 23% | 43% | 37% | 36% | |

| Margin | -2.50% | -7.59% | 8.00% | -11.56% | -9.06% |

NB: 2014 Q4 is November 2013 to January 2014, the quarter just passed, not a forecast for the future.

Salesforce can be congratulated for NOT meeting their prediction of a quarter of a billion dollar loss. They only lost $219m in the end, coming in $31m under their prediction.

Looking To The Future

Their prediction for the next quarter is for an GAAP EPS of between –$0.22 and –$0.23, which, for 613 million shares, generates a total loss of about $138m (the largest quarterly loss they have ever recorded if they achieve it). They expect revenue to be around $1.210 billion giving us a margin of –11%.

Their prediction for the next year is a GAAP EPS of about –$0.52 on 624 million shares which is a total loss of $324m. This makes this year’s loss of $219m seem like a drop in the ocean. They expect a full year revenue of around $5.3b, which means their expected margin is –6%; an improvement but still the wrong side of zero.

Revenues and Costs

Probably the biggest point of note in the financials is, in regards to the revenue growth and cost growth. Revenue Growth, year on year was 37%, almost a historical high. Unfortunately, the annual cost growth is accelerating and reaching levels which are also approaching record highs. Here is the historic graph.

Please note: In putting this together I realised I had previously miscalculated the revenue growth. I have adjusted the past three quarterly report blogs to reflect this, although it did not have a huge impact on the articles.

We can see in the graph that, traditionally, the two lines trend in a similar direction (with cost growth occasionally trying to break free) and cost growth outpacing revenue growth for most of the last four years.

What does this mean? It means that it is impossible for the company to achieve profitability until either costs are controlled or revenues accelerated to even higher levels than the crazy-high levels they are already. To approach profitability, the red line MUST go below the blue line. The margin at this stage is –9% meaning for every $10 worth of services they produce, they receive $9 in compensation. As mentioned, next quarter they are looking at a margin of –11%.

Does the CFO, Graham Smith, care? Probably not given he is leaving Salesforce next year in March. I expect he will keep revenues growing, hanging the expense. What about Marc Benioff, CEO? Marc says he is committed to improving non-GAAP profitability by 1.5% but, given you can do anything with non-GAAP numbers, it is like saying you are committed to improving the health of garden fairies. The company’s prediction for the next quarter shows a further deterioration in GAAP margins so while non-GAAP numbers may turn out ok, they expect the GAAP numbers, the real ones, to be worse.

Salesforce’s Current Assets

If things get tough for Salesforce, they will look to their assets to prop up the company until things improve. Therefore, I thought I would look at their assets this quarter to see what they have in reserve for a rainy day. Financial reports talk of ‘Current Assets’ (the stuff that is easy to sell such as cash in the bank) and ‘Non-Current Assets’ (the stuff you cannot easily sell such as office buildings). So, let us look at Salesforce’s current assets.

Cash and cash equivalents: $782m (29%)

Short-term marketable securities (shares): $57m (2%)

Accounts receivable (money owed to Salesforce): $1.36b (51%)

Deferred commissions: $171m (6%)

Prepaid expenses and other current assets: $309m (12%)

The percentages are how much each class represents of the total. Clearly, the big amounts are cash and money owed to Salesforce. Cash is an excellent current asset to have; it is readily available and perfect to weather a storm. Accounts receivable is not as friendly as a current asset because you have to chase the debt and, if the person owing you the money has an idea you are in financial trouble, they are more likely to act slowly and see if the problem goes away i.e. Chapter 11/bankruptcy.

A few years ago now, this famously happened to a company in Australia called OneTel, a telecommunications company. Like Salesforce, they had amazing growth in terms of revenue and market share and, unlike Salesforce, they were very profitable. Where they ran into problems was in paying their bills. Because so much money was tied up in their client’s bills (accounts receivable) and it was hard to chase up, they eventually ran out of available money to pay their debts and they went bankrupt. Even successful companies can go bankrupt if they do not maintain healthy current assets.

So how have these two asset classes (cash and accounts receivable) changed over time?

NB: These are the unaudited numbers until the annual report comes out but they should be right.

Other than a big stockpile in the first quarter last year, cash has stayed around $600-700m. The accounts receivable has shot up though. In fact, since last quarter, it has more than doubled. I will need to verify the numbers when the annual report comes out but, if true, this means twice as much debt to collect if they need the money. I will be watching this as part of future quarterly blog reports.

Earnings Call Buzzword Bingo

As usual, we take the quarterly earnings call transcript to see what is weighing on the minds of our two big ‘C’s (as in C-Level executives), Marc Benioff and Graham Smith.

Honourable two-word phrase mentions go to “cash flow” (mentioned 11 times) and “deferred revenue” (mentioned 10 times).

| 2013 Q4 | 2014 Q1 | 2014 Q2 | 2014 Q3 | 2014 Q4 | |

| Number of words | 3800 | 2800 | 3500 | 3700 | 3700 |

| Customers/Customer | 40 | 32 | 40 | 39 | 25 |

| Revenue | 45 | 32 | 37 | 37 | 29 |

| Cloud | 22 | 16 | 23 | 31 | 14 |

| ExactTarget | 0 | 0 | 24 | 21 | 15 |

| Platform | 10 | 12 | 19 | 21 | 12 |

| Service | 16 | 12 | 14 | 19 | 13 |

| Sales | 8 | 9 | 14 | 16 | 4 |

| Growth | 17 | 13 | 12 | 14 | 12 |

| Marketing | 9 | 0 | 12 | 12 | 11 |

| Cash | 13 | 10 | 10 | 10 | 16 |

| Mobile | 0 | 16 | 11 | 7 | 5 |

| Operating | 0 | 9 | 9 | 7 | 10 |

| Enterprise | 15 | 0 | 6 | 7 | 3 |

| Social | 9 | 10 | 9 | 6 | 3 |

| EPS | 0 | 7 | 10 | 5 | 6 |

| Salesforce1 | 0 | 0 | 0 | 0 | 11 |

My rule for the words in this list is if they have 10 or more mentions in the most recent five periods. No words dropped off the list from last time and Salesforce1 got added.

Customer(s) and Revenue have consistently topped the mentions. Earnings and profitability got mentioned once each and, therefore did not make the cut.

Mobile is consistently dropping in mentions, as is social and the new ‘mobile app platform’, Salesforce1 is the hot topic this quarter.

Google Trends

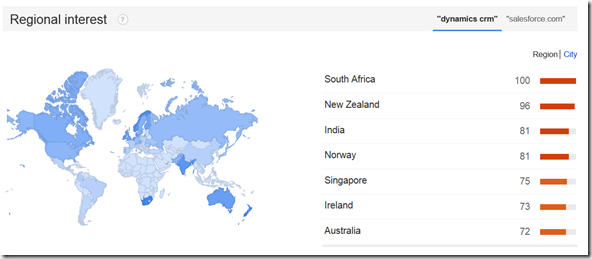

“Dynamics CRM” continues to outpace “Salesforce.com” in terms of Google searches.

Regionally, Dynamics CRM is truly the international CRM between the two products.

While Salesforce.com, when comparing the ranking levels down to 70, is much more localised in the USA, with Ireland and Singapore being common to both.

Insider and Institutional Sales

Again, according to Yahoo, insiders have sold 0.5% of their shares and the institutions have sold 2.72% of their shares.

Here is the historical trend of the last three quarters.

| 2014 Q2 | 2014 Q3 | 2014 Q4 | |

| Insider Sales | 0.50% | 0.50% | 0.50% |

| Institutional Sales | 3% | 2.75% | 2.72% |

There is a lot of consistency here with both the executive insiders and institutional owners continually selling down although the institutional sales are slowing. These are the same institutions which often have a ‘BUY’ rating for the stock and, yet, they are offloading theirs, presumably to the people they are giving the ‘BUY’ recommendation to.

Graham Smith, CFO is still regularly selling and is now down to 90,341 shares, which is too small to measure meaningfully as a percentage of the total shares. Maybe his plan is to totally sell out before he retires. At this stage, although close, he is not yet a total sell-out. Assuming Marc Benioff, CEO has not sold any shares, he is the largest individual owner of the company with a 6-7% share of the company.

Conclusions

Salesforce continues, like the titanic, on a steady course. Institutions and insiders are preparing lifeboats, albeit slowly, by offloading ownership.

As the title says, Salesforce are being consistent in their disregard for profits and reaping the reward of receiving none. They are also talking about the same things they have always talked about (customers and revenue). However, complacency is not an option with Dynamics CRM being at the forefront of people’s minds, as much as Salesforce.

My advice to Salesforce would be, if this is part of a bigger strategy, get accounts receivable under control because, in tough times, no one runs away faster than the people who owe you money. Build up the cash reserves and set yourself up for a rainy day. Then, work out what it will take to bring the company back into GAAP profit and do it.

I truly believe that, if Salesforce can get their finances under control, they will be unassailable. It will be interesting to see whether Marc will be brave enough to put a new CFO in place to tackle these big issues or whether he will keep always doing what he has always done and keep always getting what he always got.

2 comments:

I love postings, really interesting and you have done your homework! Creds!

Nice post and insights (again :)), thanks for sharing!

Post a Comment