It is that time again when Salesforce put out their quarterly results and I try to find the gold amongst the dirt. The title will be explained when we look at historical ownership.

The Numbers

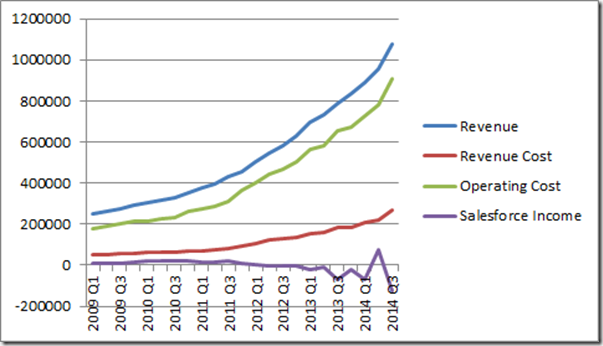

As usual, straight from the Salesforce web site. As with the last quarterly result, the detailed financial results on their web site are out of date, nine months out of date in fact. So here is the summary, combining the different quarterly reports.

| 2013 Q3 | 2013 Q4 | 2014 Q1 | 2014 Q2 | 2014 Q3 | |

| Revenue | 788,398 | 834,681 | 892,633 | 957,094 | 1,076,034 |

| Subscription Revenue | 740,600 | 785,495 | 842,221 | 902,844 | 1,004,476 |

| Revenue Cost | 186,248 | 183,362 | 208,994 | 217,717 | 268,187 |

| Operating Cost | 656,338 | 672,126 | 728,179 | 779,234 | 905,778 |

| Salesforce Income | -71,150 | -20,844 | -67,721 | 76,603 | -124,434 |

| Revenue Growth # yoy | 204,138 | 202,768 | 197,166 | 225,445 | 287,636 |

| Revenue Growth % yoy | 35% | 32% | 28% | 31% | 36% |

| Total Cost % yoy | 42% | 34% | 31% | 34% | 39% |

| Staff | 9,319 | 9,801 | 10,283 | 12,571 | 12,770 |

| Staff Growth (yoy) | 34% | 26% | 23% | 43% | 37% |

| Margin | -9.02% | -2.50% | -7.59% | 8.00% | -11.56% |

NB: A miscalculation in the revenue growth at the time of original writing has now been adjusted in the table above. Related commentary below has been lined through.

Specific points of note include revenue has broken through the $1b/quarter barrier, catching up with costs (Revenue Cost + Operating Cost) which was there last quarter. In terms of profit, Salesforce has returned to old form. With no IRS check to offset the losses, Salesforce shows a $124m loss this quarter, double the loss of the first quarter and the largest quarterly loss in the history of the company, both as a raw number and as a percentage of sales (margin).

Revenue growth (as a percentage, year on year) is the lowest it has been in over three years.Cost growth, as can be seen above is the highest since this time last year.

Revenues and Costs

Revenues are always Marc’s ‘good news story’ with Salesforce and making sales of $1b per quarter is a huge achievement. The flipside, which rarely gets Marc’s voice, are the costs. The fact is costs are outgrowing revenues unabated. In terms of the difference between the year on year percentage growth, we are now looking at a 15% 3% difference (39% – 24%36%). This is the rate of acceleration Salesforce’s costs have over its revenues. If this was a car race, not only are both cars travelling at a furious pace, and getting faster, but the costs are sailing away into the distance with revenues struggling to keep up.

That 15% differential has not been seen since the bad old days of 2011 when costs were growing at around 50% year on year.

Salesforce’s Crystal Ball

In my last quarterly report, I mentioned that Salesforce had predicted how much they would lose in this quarter and the next, predicting a loss for the year of just over a quarter of a billion dollars. Salesforce predicted, for this quarter, a loss of $111m. Unfortunately, at just over $124m, the actual loss exceeded expectation. Therefore Salesforce is on track for meeting its predict target of a loss of $257m.

Margins

The margin is the difference between what you sell something for and what it cost you to produce. Salesforce continues to struggle with this one.

The ’Salesforce Income’ (margin) is the curve at the bottom. There are two things I do not like about this curve. Firstly, it is heading in the wrong direction. There was a time when Salesforce had profit AND growth, which is a formidable position. These days the growth is there but the profits have gone.

The second thing I do not like about it is the shape. The curve is becoming jagged instead of smooth. The last big bump is because of the IRS check but even removing this we are looking at a sawtooth rather than a steady trend. I see this and think of a tug of war between the drag of the business model and the reactive strategies of the business. For years, the business model was guiding margins on a steady, albeit undesirable, path. Now internal strategies are being used to pull the margins back into the right direction but, like a race car hitting a curve, it is resisting and wants to continue on its path.

The Salesforce apologists will argue the margin decline is not all bad and that profit is being sacrificed for continued growth. If this is the case, and this has always been the game plan, why did Salesforce spend all those years making a profit when they could have been gaining additional market share? This argument that it is ok to gain market share and not manage margin decline is one I do not buy.

Earnings Call Buzzword Bingo

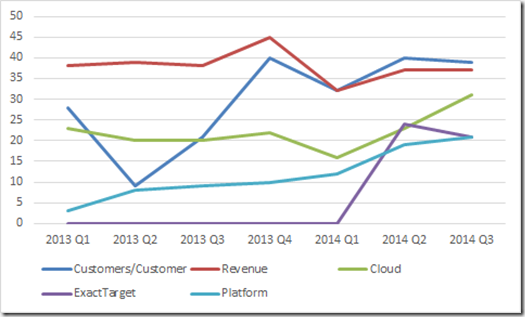

Taking the quarterly transcript of CEO Marc Benioff and CFO Graham Smith we crunch the numbers to see what is on their mind compared to previous quarters.

Here is a the graph for the five most popular words.

The topics of ‘Customer/Customers’, ‘Revenue’ and ‘Cloud’ are, of course, mainstays of Marc and Graham’s speeches. ExactTarget is a recent acquisition, which explains the sudden appearance. ‘Platform’ is an interesting one and shows a shift in the Salesforce paradigm. The platform in this case is Salesforce One, their development platform for business applications. Do not watch the video; it is full of marketing hype and tells you nothing useful. Read the web page instead. You have been warned.

In terms of other terms on the rise or decline, here is the table.

| 2013 Q3 | 2013 Q4 | 2014 Q1 | 2014 Q2 | 2014 Q3 | |

| Number of words | 3000 | 3800 | 2800 | 3500 | 3700 |

| Customers/Customer | 21 | 40 | 32 | 40 | 39 |

| Revenue | 38 | 45 | 32 | 37 | 37 |

| Cloud | 20 | 22 | 16 | 23 | 31 |

| ExactTarget | 0 | 0 | 0 | 24 | 21 |

| Platform | 9 | 10 | 12 | 19 | 21 |

| Service | 9 | 16 | 12 | 14 | 19 |

| Sales | 9 | 8 | 9 | 14 | 16 |

| Growth | 17 | 17 | 13 | 12 | 14 |

| Marketing | 10 | 9 | 0 | 12 | 12 |

| Cash | 9 | 13 | 10 | 10 | 10 |

| Mobile | 7 | 0 | 16 | 11 | 7 |

| Operating | 0 | 0 | 9 | 9 | 7 |

| Enterprise | 7 | 15 | 0 | 6 | 7 |

| Social | 13 | 9 | 10 | 9 | 6 |

| EPS | 0 | 0 | 7 | 10 | 5 |

The one that stands out for me is ‘Social’. How the mighty have fallen. Once a foundation of the Salesforce strategy, the ‘Social Enterprise’ term has gone as a result of a backlash from the not-for-profit movements which coined the term well before Salesforce tried to trademark it. ‘Mobile’ is also interesting and it will be one I keep an eye on.

Google Trends

A milestone has been reached.

“Dynamics CRM” as a search term is now more popular than “salesforce.com”. I must admit I have been waiting for this day for quite a while. The significance of this is not straightforward to divine. There is some art to this science in that the search terms are subjective (what about ‘salesforce’ or ‘microsoft crm’, for example).

What I think is noteworthy is that the search trend for Salesforce is not aligned to their revenue growth. Perhaps this suggests significant new revenue is not coming from new business but expanding existing business. Perhaps it suggests people are finding out about Salesforce through new channels, outside of Google. I am not sure.

Insider and Institutional Sales

Again, using Yahoo, we see that insiders have sold 0.5% of their total holdings in Salesforce over the past six months. Institutions have sold off 2.75% of their shares over the same period.

In discussing this with fellow CRM MVP and stock trading wunderkind George Doubinski, he suggested the fact that insiders are selling is neither here nor there. To put it simply, people sell shares all the time for many reasons, which I have stated in the past. He suggested we examine the change in ownership over time.

Thankfully, we have the submissions to the SEC to give us the information. For example, here is the original prospectus for Salesforce, with the original share ownership. Here are the numbers for executives which owned more than 1%.

| Executive Officers and Directors: | Number of Shares | Percentage Ownership Before the Prospectus | Percentage Ownership Before the Prospectus |

| Marc Benioff | 28,179,071 | 30.9 | 27.8 |

| Parker Harris | 2,520,507 | 2.8 | 2.5 |

| Magdalena Yesil | 2,089,165 | 2.3 | 2.1 |

| David Moellenhoff | 1,792,005 | 2 | 1.8 |

| Jim Steele | 1,350,000 | 1.5 | 1.3 |

| Craig Ramsey | 1,300,000 | 1.4 | 1.3 |

| Steve Cakebread | 1,000,000 | 1.1 | 1 |

Boards change and the only original members of the board, according to the Salesforce web site, are:

- Marc Benioff

- Parker Harris

So how has their ownership changed in the past ten years for these founders and true-believers?

Thanks to Yahoo, we know that the major shareholders are:

| Holder | Shares | Reported |

| BENIOFF MARC | 10,212,500 | Dec 28, 2012 |

| RAMSEY CRAIG | 1,384,584 | Nov 26, 2013 |

| HARRIS PARKER | 9,419 | Nov 29, 2013 |

| ROBERTSON SANFORD | 172,800 | Nov 26, 2013 |

| HASSENFELD ALAN G | 116,000 | Nov 26, 2013 |

So Marc has gone from 28 million shares down to 10 million shares and Parker has gone from 2.5 million shares down to 9,000. How does this compare to the total number of shares? Well, we know that Marc’s holding of 28,179,071, at the time of the prospectus represented 27.8% of all shares. Therefore, maths tells us the total number of shares was around 101,363,564 (let’s call it 101 million).

Looking at the last annual report (before the recent 4:1 share split) we see that as of January 31, 2013 there were 147m shares outstanding. It is possible the values for all major shareholders, except Marc are in the new split shares but we will err on the side of caution and assume not.

Running the numbers, this means Marc Benioff has gone from being a 28% owner of the company in 2004 to being a 7% owner of the company (10,212,500/146,406,655) today. In the case of Parker Harris, he has gone from owning 2.5% of Salesforce to owning essentially no part of the company.

If Marc and the executive are so positive about Salesforce, why do they own so much less than they did when they floated the company? Why do many of the executive continue to sell their holdings on practically a daily basis? It is for this reason that I refer to Salesforce as unloved. For whatever reason the father(s) of Salesforce are abandoning their baby. This being said, I am sure Salesforce will never be an orphan. With Salesforce and Oracle building closer and closer ties, if Marc sets his baby free, there will be Larry Ellison with open arms to welcome it into the Oracle family.

Conclusions

As is often the case with the quarterly reports, I find myself writing the conclusion with mixed emotions. I like Salesforce and I like the competition is brings to the market. It brought innovation and life to a stagnating CRM industry and it pains me to see dark clouds on the horizon.

Regardless of how Salesforce juggle the numbers for their non-GAAP reporting, eventually the piper must be paid and a real profit must be made. I see no indication that Salesforce plan to do this in the near future and this concerns me greatly. Perhaps this new platform play, emphasizing the development tools over the SaaS offerings will be the key. It seems Salesforce is trying to be the appstore for business applications, which is an interesting play. If they get the adoption, this will make them formidable, in the same way that the sheer volumes of applications for Apple is a sustainable competitive advantage which the others struggle to assail.

The Google trends result is interesting. The graph clearly shows people are not asking about Salesforce via Google as much as they once did. This surprises me in that the revenue growth would suggest increasing popularity, not decreasing. Perhaps Salesforce will, once again, release subscription numbers in the future and we can see how this correlates to these seemingly contradictory results.

Finally, we have the result of the executives and their seemingly waning affection for their creation. Perhaps they are moving on to other things. Perhaps they really need the money. Again, whatever the reason my hope is Salesforce continues with or without their support.

1 comment:

Very useful information thanks for sharing Amazing information

Post a Comment