Salesforce has just released their third quarter results. This gives me an opportunity to see how they are tracking financially but also to fix up an error in a previous post. Back in September I had suggested that salesforce was getting away from Microsoft in terms of subscriptions. It turns out my ability to combine tables was in error and thus the conclusion that salesforce was moving away from Microsoft was also in error. Let us delve into it shall we?

The Third Quarter Financial Results

For the details, you can go here.

My last review of the financials was back in September. At that time, salesforce had made a loss for the first time since the start of 2009. Unfortunately they have now made it two quarters in a row. The loss is smaller than before, but a loss regardless. If salesforce do not make a profit of more than $7.5m in the last quarter, they will make a net loss for the year. Marc should make some calls into the North Pole. They have a bunch of folk up there trying to track customers worldwide and delivering goods to them via overnight delivery. They might need some help in the next couple of months.

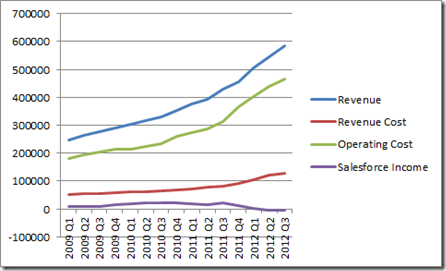

Here is the graph of the financials.

Those non-GAAP revenue costs appear to be tapering but those pesky operating costs keep growing. If only salesforce did not have to operate a business (improve the product, pay commissions, paint the world in adverts, run offices etc.) they would be making a fortune.

I again embraced the pleasure of listening to the earnings conference call and no one bothered drilling into the loss. Marc was certainly unconcerned, but this is no surprise. The fact that the analysts on the call were not overly concerned either was surprising. The analysts have noticed the slowdown in billings growth but that is about it. So, like a water balloon left on a running tap (faucet for our American readers), it is all still about growth and not about the long term consequences.

Subscription Numbers

Unfortunately, salesforce no longer report subscription numbers with their quarterly results. However, the revenue results can give us a clue. Here is the obligatory table of financial results.

| 2011 Q1 | 2011 Q2 | 2011 Q3 | 2011 Q4 | 2012 Q1 | 2012 Q2 | 2012 Q3 | |

| Revenue | $376,813 | $394,372 | $429,087 | $456,867 | $504,364 | $546,002 | $584,260 |

| Revenue Cost | $71,581 | $77,790 | $82,131 | $92,311 | $103,066 | $120,910 | $128,565 |

| Operating Cost | $272,182 | $286,900 | $311,800 | $364,947 | $404,101 | $440,840 | $465,852 |

| Salesforce Income | $17,745 | $14,744 | $21,072 | $10,913 | $530 | -$4,268 | -$3,756 |

| Subscribers | 2,319,000 | 2,554,400 | 2,790,400 | 3,000,000 | 3,321,800 | 3,640,000 | 3,895,067 |

| Customers | 77,300 | 82,400 | 87,200 | 92,300 | 97,700 | 104,000 | 111,288 |

| Revenue Per Subscriber | $162 | $154 | $154 | $152 | $152 | $150 | $150 |

| Revenue PUPM | $54 | $51 | $51 | $51 | $51 | $50 | $50 |

| Revenue Growth ($) yoy | $71,889 | $78,311 | $98,538 | $102,818 | $127,551 | $151,630 | $155,173 |

| Revenue Growth (%) yoy | 24% | 25% | 30% | 29% | 34% | 38% | 36% |

The first four rows and the Revenue Growth ($) are in the thousands.

Numbers in red are my best guesses using the average company size as an indicator of subscriber numbers.

In this last quarter we have had to be a little smarter because the customer numbers were not released. In this case I have used the Revenue Per User Per Month which has tracked at around $50-51 for the last 18 months. Combining this with the Revenue numbers gives us a number for subscribers and, again, using the predicted average company size we can get a number for customers.

Assuming things are on track, salesforce is poised to make four million subscribers before the end of the next quarter.

Fixing Up My Market Maturity Numbers

As mentioned, back in September I made an error with the market maturity numbers which led to the conclusion salesforce were getting away from Microsoft. Time to fix that error. Here is the corrected table.

|

| SFDC Subscribers | SFDC Customers | MSFT Subscribers | MSFT Customers | Subscriber Ratio | Customer Ratio | Difference in Subscribers | Total Subscribers | Customer Size Ratio |

| Mar-06 | 423,667 | 22,298 | 150,000 | 6,000 | 2.82 | 3.72 | 273,667 | 573,667 | 1.3 |

| Oct-06 | 556,000 | 27,100 | 250,000 | 8,000 | 2.22 | 3.39 | 306,000 | 806,000 | 1.5 |

| May-07 | 775,200 | 33,704 | 400,000 | 10,000 | 1.94 | 3.37 | 375,200 | 1,175,200 | 1.7 |

| Mar-08 | 1,198,333 | 44,383 | 500,000 | 11,000 | 2.40 | 4.03 | 698,333 | 1,698,333 | 1.7 |

| Feb-09 | 1,533,800 | 56,807 | 750,000 | 15,500 | 2.05 | 3.66 | 783,800 | 2,283,800 | 1.8 |

| Jul-09 | 1,769,600 | 63,200 | 1,000,000 | 20,833 | 1.77 | 3.03 | 769,600 | 2,769,600 | 1.7 |

| Apr-10 | 2,319,000 | 77,300 | 1,100,000 | 22,000 | 2.11 | 3.51 | 1,219,000 | 3,419,000 | 1.7 |

| Jul-10 | 2,554,400 | 82,400 | 1,400,000 | 23,000 | 1.82 | 3.58 | 1,154,400 | 3,954,400 | 2.0 |

| Apr-11 | 3,321,800 | 97,700 | 1,700,000 | 27,000 | 1.95 | 3.62 | 1,621,800 | 5,021,800 | 1.9 |

| Jul-11 | 3,640,000 | 104,000 | 2,000,000 | 30,000 | 1.82 | 3.47 | 1,640,000 | 5,640,000 | 1.9 |

Essentially, the error came because salesforce quote their financials by fiscal year. So the most recent results are Q3-2012 even though we are still in 2011. This led me to put the previous years subscription numbers in for salesforce in all but the last quarter. I also misunderstood when the salesforce quarters started. I had assumed fiscal year started on the first of January. It appears it actually starts on the first of February so this has also been adjusted. The above table, as far as I know, is now correct.

Again, the numbers in red are best guesses based on the information at hand.

The total number of subscribers for the two companies continues to grow unabated with it likely that the two products are already serving six million subscribers or more.

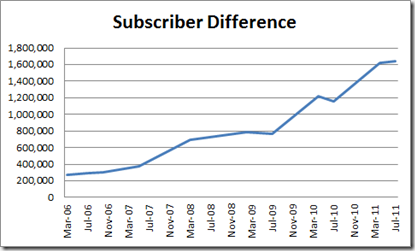

The graphs no longer show the jump seen previously. We now see that either the ratio of subscribers is flattening to just below two or the ratio is decreasing and the difference is flattening out. Time will tell which is correct. What is clear is that salesforce are not pulling away through the subscriber land grab acquisitions as previously speculated and Microsoft are still in the chase. Honestly, nothing would please me more than another drop in the subscriber ratio and a reduction in the subscriber difference. I cannot wait to see if Santa Marc will package that up for me in the next quarter results.

Google Trends

Here is the latest difference between “dynamics crm” and “salesforce.com” according to Google trends. In the past I have used a linear trend line but I do not feel this accurately represents the movement (with an r-squared value around 50% its presentation was unjustified). To this end I have changed the trend line to a moving average graph, akin to what is often used for stock prices. The advantage of this kind of trend line is it smooths out the fluctuations and still gives an indication of the general direction of movement. The graph indicates Dynamics CRM continues to gain mindshare amongst the Google search population.

Conclusions

My first conclusion is avoid crunching numbers in the wee hours (although I am writing this at 2am so I am not good at taking my own advice). Moreover, as any good theoretical physicist will tell you, if you do crunch numbers and a strange result pops out check and re-check to make sure you are not going to put something out there which is a nonsense.

In regards to the salesforce numbers, I predict that salesforce will make their four million subscribers by the end of the year and this year will result in a financial loss for the company. I often say “one is an outlier, two is a coincidence and three is a pattern”. Let us see if salesforce can turn their financial losses into a pattern next quarter.

As for accelerating away from Microsoft, this is far from the case. Microsoft continue to pursue salesforce like a dog chasing a car. Whether the car will stall or shift into second gear is yet to be seen.

Finally, Microsoft continue to gain public mindshare and this does not appear to be slowing. While it was close in July 2011, we are yet to see a day when more people search for Dynamics CRM than salesforce.com. Appearances would suggest that day, however, will be soon.

1 comment:

Great analysis. One item I find to be interesting is the % of Sales and Admin Expense vs Revenue. A well run business should see reduction in the % or at least at positive operational benefit from a CRM business strategy. Of all the companies they should be leading by example. Their SG&A % has risen to be 67% of Revenue and their Sales Expense has risen to 52% from 48% last year and 46% previously. So operationally they are much less efficient than before and trending up. Additionally, their professional services have have fallen to only 6% of Revenue, which to me a leading indicator of where they are headed. As complex enterprises are not as enchanted with them as they use to be with their Professional Consulting Staff. I am sure they could spin this differently, just my take.

They still feel like a start up firm, buying up lots of companies, creating a lot of buzz in the market. But as a CRM Consultant I look at that app as say "Where is the Beef?" So I realize that a lot of expense and inefficiency is from the purchases, and in 2 years or so these admin expenses will be reduced.

If I was a major investor I would be questioning the idea that buying up companies without a seamless integration strategy or a good platform play is just a waste of my money. Why not just take the time to invest in the IP yourself, hire some great folks, innovate with partners, lead by example. It seems like they have run out of good innovative ideas. Without a doubt they have only one drum to beat, that is the cloud message, which the industry has responded to, so it is time to move on.

Their stock is tanking today, and well on the way to a major correction. The strike price for some folks was up to $200 this summer, it is trading at $114 today.

Post a Comment