Another three months has passed and another set of results are available for review. In the previous analysis, I predicted how Salesforce would fare. I did not do that this time but will have a go for next quarter. Also, I will use my newly discovered method for predicting the Salesforce subscription numbers in this review.

The Numbers

Salesforce have revamped their web site, including the financials, removing the historical financials PDF which was increasingly out of date. Five years of financial data are available, eight years of annual reports and the SEC filings.

Here are the numbers for most recent five quarters.

| 2014 Q2 | 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | |

| Revenue | 957,094 | 1,076,034 | 1,145,242 | 1,226,772 | 1,318,551 |

| Subscription Revenue | 902,844 | 1,004,476 | 1,075,001 | 1,147,306 | 1,232,587 |

| Revenue Cost | 217,717 | 268,187 | 273,530 | 292,305 | 307,831 |

| Operating Cost | 779,234 | 905,778 | 975,458 | 989,808 | 1,044,154 |

| Salesforce Income | 76,603 | -124,434 | -103,746 | -96,911 | -61,088 |

| Revenue Growth # yoy | 225,445 | 287,636 | 310,561 | 334,139 | 361,457 |

| Revenue Growth % yoy | 31% | 36% | 37% | 37% | 38% |

| Revenue Growth % mom | 7% | 12% | 6% | 7% | 7% |

| Total Cost % yoy | 34% | 39% | 46% | 37% | 36% |

| Staff | 12,571 | 12,770 | 13,312 | 14,239 | 15,145 |

| Staff Growth (yoy) | 43% | 37% | 36% | 38% | 20% |

| Margin | 8.00% | -11.56% | -9.06% | -7.90% | -4.63% |

| Growth Difference | -3% | -3% | -9% | 1% | 2% |

| Cash | 579,881 | 651,750 | 781,635 | 827,891 | 774,725 |

| Accounts Receivable | 599,543 | 604,045 | 1,360,837 | 684,155 | 834,323 |

| Cash/AR | 97% | 108% | 57% | 121% | 93% |

Staff growth is significantly down, to about half of the rate previously, which is very surprising. one to watch.

As for profits, they made a 61 million dollar loss which, apart from that one quarter where they got a tax break, means Salesforce has not made a profit for three years.

Subscribers

With a strong correlation of transactions to subscribers, I derived the formula:

Transactions = 150.27 * Subscribers – 40,000,000. So, for example, when there was 53 million transactions, back in September 2006, the predicted subscriber count is around 619,000. We know that the subscriber count at that time was around 556,000, which means we are about 10% off.

The trust page tells us the highest recent level of transaction was July 22, 2014 which had 2,037,819,946 transactions. This gives a subscriber count of 13.8 million. This is a LOT of subscribers but, if it is true, it means the average revenue per user per month is $32, which is not even a Sales Cloud Professional subscription. It also means that, on average, Salesforce loses just under $1.50 per subscriber per month.

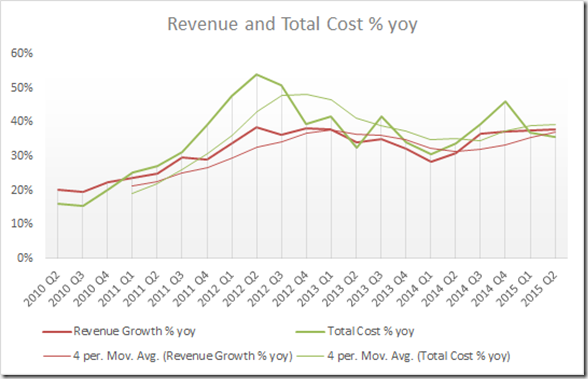

Revenue and Cost Growth

Revenue growth remains solid and appears to be accelerating slightly. Salesforce have also got their revenue growth above their cost growth, which means they are heading back to profitability. In terms of the difference between the revenue growth and cost growth being 2% or more, this is the first time it has happened in about five years, so it will be interesting to see how this progresses next quarter. If they are not careful, it might become a habit.

In the above graph I have also added four-period moving averages. This is an average used to look for trends in movements. As can be seen, the moving average for Cost Growth has remained above the average for Revenue Growth for the last four years. However, now they are approaching and, if they cross in the future, it will be a good sign for Salesforce.

Cash and Accounts Receivable

Despite optimism about the decrease in Accounts Receivable and increase in Cash in the previous quarter, this trend has reversed this quarter, which is a pity. I also mentioned in the last review that historically, Cash ran above Accounts Receivable and now they seemed to be coming to a similar level. By adding in the four period moving averages, we see this to be the case. We also see that Accounts Receivable, for the first time has nudged above Cash in terms of the actual amounts and as an average. For me, this is not a good sign. As I mentioned last time, cash in the bank is a better asset than money owed to you by customers.

Earnings Call Buzzword Bingo

The rule is the words on the list have had ten or more mentions in the past five periods with the text used being the call transcript after the introduction and up to, but not including, questions.

| 2014 Q2 | 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | |

| Number of words | 3500 | 3700 | 3700 | 2400 | 4731 |

| Customers/Customer | 40 | 39 | 25 | 22 | 38 |

| Revenue | 37 | 37 | 29 | 19 | 27 |

| Cloud | 23 | 31 | 14 | 15 | 22 |

| ExactTarget | 24 | 21 | 15 | 7 | 8 |

| Platform(s) | 19 | 21 | 12 | 10 | 13 |

| Service | 14 | 19 | 13 | 13 | 15 |

| Sales | 14 | 16 | 4 | 6 | 6 |

| Growth | 12 | 14 | 12 | 9 | 18 |

| Marketing | 12 | 12 | 11 | 5 | 10 |

| Cash | 10 | 10 | 16 | 10 | 11 |

| Mobile | 11 | 7 | 5 | 2 | 8 |

| Operating | 9 | 7 | 10 | 11 | 11 |

| Enterprise(s) | 6 | 7 | 3 | 8 | 10 |

| Social | 9 | 6 | 3 | 2 | 4 |

| EPS | 10 | 5 | 6 | 6 | 6 |

| Salesforce1 | 0 | 0 | 11 | 6 | 7 |

| Dreamforce | 11 |

Quite the word-fest this call, with CEO Marc Benioff, President Keith Block, Executive VP Graham Smith, and CFO Mark Hawkins all speaking.

Dreamforce is a new term this quarter (it is coming up in October, so this makes sense). Social has dropped off the radar, presumably because Salesforce is no longer the Social Enterprise. Similarly, EPS (Earnings Per Share) is falling out of favour as a measure for the earnings calls. The three most popular words, as usual are “Customer(s)”, “Revenue”, and “Cloud”.

One phrases of note: “running their entire business right from their phone” (two mentions). This is Marc’s vision of the future. Run it from your wristwatch, I say.

One word conspicuous in its absence was ‘profit’. It was not mentioned in the transcript once, nor in the question and answer session.

Google Trends

As usual, I pump “Dynamics CRM” and “Salesforce.com” into the Google Trends analyser and see what comes out.

Red is “salesforce.com” and blue is “Dynamics CRM”. Dynamics CRM is flattening out while Salesforce.com continues to drop.

Insider and Institutional Sales

According to Yahoo, this is how we stand, in terms of insider and institutional sales.

| 2014 Q2 | 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | |

| Insider Sales | 0.50% | 0.50% | 0.50% | 0.50% | 0.40% |

| Institutional Sales | 3% | 2.75% | 2.72% | 2.71% | 2.67% |

It seems, in both cases, while shares are being offloaded, the rate it is happening is slowing down. Perhaps attitudes are changing towards the future of the stock.

Looking to the Future

Salesforce predict the next quarter will have revenues between $1.365b and $1.370b and a loss of between $80-86m.

I think revenues will be closer to $1.4b and the loss will be around $40m so we will see who gets closer.

Conclusions

If we listen to the earnings call, if would be easy to think Salesforce is a company going from strength to strength and there is no denying, for a company their size, they do have enviable revenue growth. However, no matter how it is dressed up, financially, it is a bit of a mixed bag. Obviously three years of unprofitable business is bad and a degradation of the quality in the assets is bad but then we have the improved sales/cost growth and slowing of the insider and institutional sales.

The lack of profits is often explained away by saying that Salesforce is making a loss so they can aggressively target market share. Similarly, I imagine the improved sales/cost growth could be explained by the degradation of assets i.e. relaxing payment terms in order to win more business. How sustainable these practices are I do not know but living in denial by not even talking about profits or the lack thereof is a recipe for disaster.