I just did a presentation at Decisions Spring 2012 and I thought it would be interesting to summarize the presentation here as well as it is something I feel is important, given the hype and confusion regarding social networks and social CRM at present. The exercise has also clarified some of my thinking on the subject so even if you saw the presentation, this may help you understand my perspective.

The Imperative for Change

The way we engage with vendors and engage with each other is changing. It used to be that the primary source of information for a product was the manufacturer. With the advent of the internet, information is ubiquitous. All human knowledge (or, at least, the practical and useful stuff) is now a mere URL away. Also, people who we would only see at weddings and funerals, are now a click away thanks to sites like Twitter, LinkedIn and Facebook.

This change may feel sudden but they have in fact been building up over a number of years. Back in 1999, The Cluetrain Manifesto was written which predicted that the internet would force companies to change the way they treat and interact with their customers. Classic “theses” include:

“Markets are conversations.”

“The Internet is enabling conversations among human beings that were simply not possible in the era of mass media.”

“People in networked markets have figured out that they get far better information and support from one another than from vendors.”

“Already, companies that speak in the language of the pitch, the dog-and-pony show, are no longer speaking to anyone.”

“We are immune to advertising. Just forget it.”

While it has been over ten years, these quotes are as powerful today as back then and certainly more understandable. Most of us are part of the ‘networked market’ now, we just called it ‘social’.

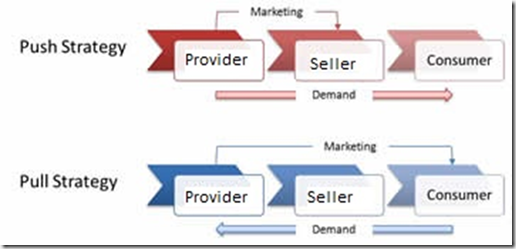

Push and Pull Marketing

Now we have an appreciation of where we are heading, let us reflect on where the traditional corporate conversation is. Traditionally, marketing has been divided into two categories: Push and Pull.

Push marketing is the convincing of a known party (a seller) to conduct a sale.

Pull marketing is the convincing of an unknown party (a consumer) to initiate a buy.

Examples of these strategies can be seen today with the partner model of Microsoft. Microsoft often offer incentive to ‘the channel’ to promote the sales of a certain product. For example, they may promote a “get a Dynamics GP license for $1” offer to the partners to encourage them to push the product.

An example of a Microsoft “pull strategy” are the inspiring adverts we have all seen telling us how Microsoft enables us to achieve more.

The Apple iPad advertisements are also classic examples of a pull strategy.

The Problem With the Push and Pull Model

There is a growing problem with defining advertising strategies as “push” or “pull”. The problem is it assumes an intermediary. In the case of Microsoft, the model is still valid in that there is a partner network. However, for many products, the distance between the manufacturer and the buyer is shrinking. It also assumes a largely passive seller with the buying decision being controlled through the result of actions of the manufacturer.

Let us consider the example of a used car. While advertising may pull me to choose a certain dealership, there is no push as there is, effectively, no manufacturer to profit from the sale. The push now shifts so it is between the user car salesman to the buyer. It is now the seller’s actions which promote the sale. He may, for example, promote a specific car on the lot that he wants to sell. Therefore, while in the traditional model, push was an interaction between the manufacturer and the seller and pull was an interaction between the manufacturer and the buyer, this has devolved into two types of interactions between the buyer and seller.

Let’s listen to the conversation:

Seller: You should buy this car here (push)

Buyer: I’ve been looking at online at the cars on the lot and I want you to sell me this one at the same price (pull)

Seller: Deal

Another interesting note in this interaction is that the buyer does not say where they were getting information about the cars on the lot. While, for a traditional push, it would be from the seller, with the myriad of online conversations it is not necessarily the case.

However, putting aside the social aspect for the moment, from the seller’s perspective, the push and pull strategies now become:

Push Marketing is promoting a sale with a known buyer

Pull Marketing is promoting a sale with an unknown buyer

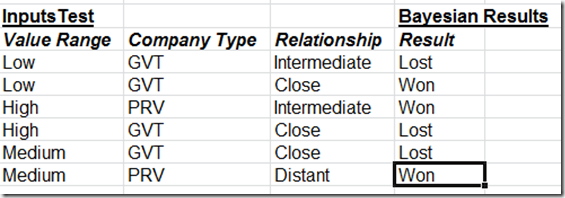

Why Traditional CRM Systems Only Do Half the Job

Traditionally, CRM systems contain information on who you are looking to sell to, who you have sold to in the past and who you have failed to sell to in the past. In other words, CRM systems are great at holding information on known potential buyers. This means they are great for push marketing and most traditional CRM systems have a marketing module for direct marketing (the poster child for push).

Where they fall short is providing insight into unknown buyers. The best they can do is give rough guidelines of the kinds of people that may purchase based on those that have purchased in the past but they will never tell you a phone number of someone who is ready to buy at this moment. In other words, traditional CRM systems are almost useless for communicating with the unknown audience for your product.

The Problem With Pull

To make matters worse, traditional pull advertising (billboards, television etc.) is becoming less effective in that a consumer now has many sources of information, via the internet, to aid in their purchase decision. It is well and good getting an idea that your key demographic is “affluent 30-somethings” and putting a message out in the wild targeting this group but the “affluent 30-somethings” now have many other sources, all self-selected and these sources are likely to match their personal profile much better than trends generated from a database.

How Do We Make CRM Systems More Pull-Friendly?

While there is definitely value in bringing business intelligence tools to CRM to gain insights into customers, the information such tools provide us on customers we do not know about is limited. For example, let us imagine there is a new market for our product completely outside of our traditional selling space. No analysis of our known customers is going to reveal this insight. To do this, we must look elsewhere.

The good news is the ‘unknowns’ are communicating their thoughts and desires every day and in a way that we can easily access. Through social networks is it possible to read the minds of millions of people we would otherwise have no interaction with. Insights from these new conversations can be used to:

- Generate sales leads

- Provide insight into product innovation

- Identify problems consumers may be having with the product

- Gain a better understanding of competitors

Therefore to make a CRM system more pull-friendly it needs to:

- Allow us to easily generate content to promote social conversations

- Allow us to capture the participants of these discussions in CRM so we can establish a direct relationship with them and engage in push marketing i.e. generate a sale

Brent Leary summarized the idea well in the following diagram.

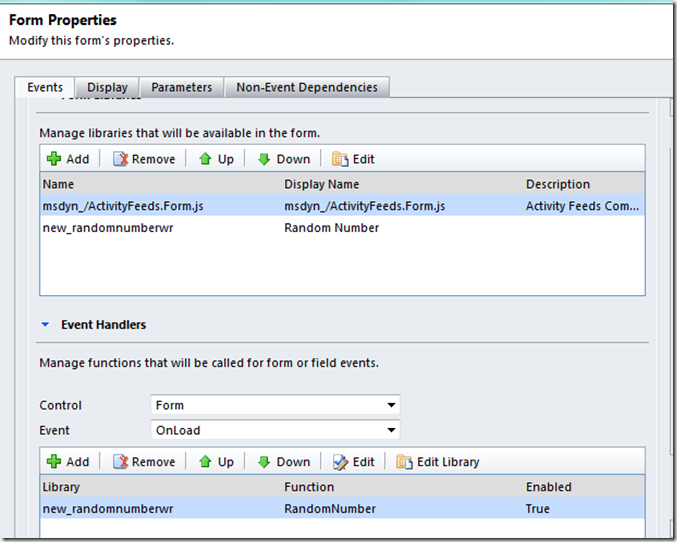

Why Many CRM Makers (and Their Customers) Are Still Getting it Wrong

Even the most social of CRM manufacturers do not see the complete picture. While many allow for ‘monitoring’ e.g. displaying a contact’s twitter feed on their contact record, very few allow the generation of content to promote discussion and even fewer provide a simple mechanism to capture those discussions and bring them into a traditional sales/support process.

The reason these solutions sell so well is that many companies also fail to see the big picture. According to IBM, 80% of companies have a social presence but very few have worked out how to use it for CRM. You may also hear the common complaint that it is difficult to measure the return on investment (ROI) on social marketing. The fact is, while these organisations are spending lots of money generating awareness online, they are failing to promote a call to action and therefore are generating precious little revenue from their many thousands of Facebook fans.

I am sure if I painted my face on the moon it would generate a lot of attention for me but without giving people a clear path to purchase, I will have simply spent a lot of money to make me famous, but not rich.

In fact, I only know of one product which handles the issue of pull marketing and social networks for CRM well. This product is Webfortis Parrot. I have no vested interest here, I just love the product and believe it fills the gap to make Dynamics CRM a complete push and pull solution.

Why Bringing it Into CRM is Vital

The reason it is essential that the conversation be brought in and managed through a CRM system is simple; social networks allow you to keep tabs on people but they do not make for meaningful relationships. The notion that a traditional CRM system is some kind of inferior tool for creating strong relationships is simply not true. Steven McKee recently posited this in Business Week and I fundamentally disagree with him. It is true that traditional CRM systems can be used poorly and it is also true social networks ensure all mistakes will be public knowledge within an instant but to suggest a traditional CRM is only good for one-way communication is a nonsense.

The CRM tool is only as good as the user so if a salesman is communicating poorly with their customers and using a CRM system to more efficiently manage their customers this will obviously be a more efficient path to a poor result. Conversely, if a salesperson is a good communicator and can communicate authentically, as promoted by the Cluetrain Manifesto, then a CRM tool will allow them to do this with a much larger customer base than if they were not using it.

So while it may be true that a CRM system does not, of itself, promote poor communications and poor relationships, why do we think it is better than communicating via a social network? The answer is because the research backs it up. Paul Adams, a social researcher at Facebook (formerly at Google) synthesized a mountain of academic research on the social nature of humans. Paul talks about weak and strong ties. Broadly speaking this is the difference between a friend and an acquaintance. It turns out that to communicate with strong ties, we use different channels than we do for weak ties, as shown below.

He goes on to say “Many people use e-mail for very private exchanges…Some young adults use e-mail to communicate with their strongest ties because their (online) social network is overloaded with information.”

The fact is, while we can generate a weak tie to someone through social networks, to create a strong tie to someone requires the use the traditional tools of communication such as a face to face meeting, a phone call, text messages and e-mail. These channels are, as confirmed by Steven McKee, the domain of CRM systems.

Steven is not alone in thinking social networks are a channel that is somehow different to other channels of communication but it is not; it is simply one channel available to establish a rapport with someone. However, in terms of generating that ‘trusted advisor’ status keenly sought by many salespeople, social happens to be one of the worst channels you can pick. In other words, social is great for generating the lead but lousy for progressing the sale.

Does All This Only Apply to B2C?

One of the themes in the questions asked of me after the presentation at Decisions was whether this was more of a topic for B2C (companies that sell to individuals) rather than B2B (companies that sell to other companies).

My personal belief is if you feel pull marketing is important to your marketing strategy and gaining insight into the unknowns is also important then there is value in employing the social channel. While the emphasis may be different, even in a B2B sale, the ultimate consumer is a person. For example, if I, as a seller, can gain insight into the desires of the employees of a company, I can present that information to the CEO (ideally in a face to face meeting) and use this information to close the deal.

If the CEO is not listening to the employees directly, it is likely the insights gained will be a revelation to him and this will go a long way towards establishing a strong tie with this key decision maker.

Conclusions

Traditionally, direct sale companies employed a sales force to establish strong ties with prospects. To reach the known potential buyers, which the sales force could not get to, push marketing was also used. To reach the unknown buyers, pull marketing was used.

Technology (CRM) allowed the sales force to better manage their client base and establish strong connections. Push marketing, in the form of direct mail campaigns continued to be employed, secure in the knowledge that it was cheaper to resell to a previous buyer than to sell to a new buyer. Pull marketing was also employed to attract new buyers, although this was managed outside of the CRM system.

With the advent of the internet and social networks, the value of traditional pull marketing (e.g. billboard advertising) was reduced as there were many sources of information on the same product from sources other than the seller. Therefore, to deal with this loss of marketing value, CRM systems need to assist in the generation of content to promote conversations on a given topic. They also need to be able to monitor these conversations and, if they are of interest, easily capture them within the CRM system so a relationship can be established with the potential, previously unknown, customer.

To establish this relationship, while communication could remain on the social network, research shows that the traditional channels of communication, such as face-to-face meetings and the telephone are more effective.

As all communication is between two people, it is often thought that social networks are of limited value in a B2B sale. However, as they give us insight into the people than make up an organization, there is still value to be had.

To date, CRM systems handle the social channel quite poorly in terms of content generation, monitoring and conversion into a CRM record. CRM manufacturers are aware of the problems and are rushing to address them, although even the most comprehensive CRM solutions are still lacking in this regard.