Great news this quarter for Salesforce; they reported a quarterly profit . Is this the ‘opposites’ segment of “You Can’t Do That On Television”? Is Marc seeing the value of selling $10 bills for $11 in his old age? Let us delve into the numbers and find out.

Salesforce Quarterly Results

As usual all numbers come from the Salesforce web site.

| | 2013 Q2 | 2013 Q3 | 2013 Q4 | 2014 Q1 | 2014 Q2 |

| Revenue | 731,649 | 788,398 | 834,681 | 892,633 | 957,094 |

| Subscription Revenue | 687,493 | 740,600 | 785,495 | 842,221 | 902,844 |

| Revenue Cost | 162,418 | 186,248 | 183,362 | 208,994 | 217,717 |

| Operating Cost | 582,697 | 656,338 | 672,126 | 728,179 | 779,234 |

| Salesforce Income | -9,829 | -71,150 | -20,844 | -67,721 | 76,603 |

| Revenue Growth # yoy | 185,647 | 204,138 | 202,768 | 197,166 | 225,445 |

| Revenue Growth % yoy | 34% | 35% | 32% | 28% | 31% |

| Revenue Growth % mom | 5% | 8% | 6% | 7% | 7% |

| Total Cost % yoy | 33% | 42% | 34% | 31% | 34% |

| Staff | 8,765 | 9,319 | 9,801 | 10,283 | 12,571 |

| Staff Growth (yoy) | 38% | 34% | 26% | 23% | 43% |

| Margin | -1.34% | -9.02% | -2.50% | -7.59% | 8.00% |

NB: A miscalculation in the revenue growth at the time of original writing has now been adjusted in the table above. Related commentary below has been lined through.

Sure enough, the ‘Salesforce Income’ aka ‘GAAP Earnings’ is positive for the first time in two years with a healthy margin of 8%. Even with this profit, revenues have grown around 28% year on year. So what is the secret sauce in the Salesforce recipe?

Revenue and Cost Growth

Revenues have consistently grown, year on year, at around 30% for the past three years. How about costs? Costs this quarter grew at 34% year on year. Cost growth for the past three years (apart from one quarter where sales growth inched ahead by 1%) have consistently out-paced sales growth. Sales keep growing but costs are growing faster. So if this is the case this quarter, where is the extra money coming from?

Digging Deeper

The fact is the GAAP numbers above do not reveal how Salesforce made a profit this quarter. To do that we need to look at the line items not summarised above, specifically the ‘Benefit from income taxes’. Because of Salesforce’s lack of profits, they got a tax rebate to the tune of around $130m and it is this that changed a $60m loss into a $70m profit.

What About the Future?

So will the IRS bail out Salesforce in the future? Fortunately, we do not have to speculate because Salesforce has done it for us. In their earnings press release they tell us in their guidance section how they will fare next quarter and in the year overall. Salesforce tell us that they expect a GAAP Earnings Per Share (EPS) of between –$0.19 and -$0.18 per share using a basis of 601 million shares for the next quarter. For the full year they expect a GAAP EPS of between -$0.44 and -$0.42 per share using a basis of 598 million shares.

EPS = GAAP Earnings / Number of Shares. So all we need to do is multiply the EPS by the number of shares to get the expected GAAP earnings (Salesforce income).

For the next quarter, Salesforce expect to make –$0.185*601,000,000 = -$111m. For the full year, they expect to make -$0.43 * 598,000,000 = -$257m.

Finally, we know that in the first two quarters, Salesforce made -$68m + $77m = $9m. So, we can also work out what Salesforce expect to make in their last quarter which is -$257 -$9m + $111 = -$155m. So, this financial year, Salesforce expects in earnings:

- Quarter 1: -$68m (last quarter)

- Quarter 2: $77m (this quarter)

- Quarter 3: -$111m (next quarter)

- Quarter 4: -$155m (final quarter)

Total loss: $257m

Let me be very clear on this point, I am not doing some clever extrapolation of historical numbers here; I am simply presenting the numbers Salesforce have put out in their press release. This is their expectation of the next six months, not mine. Salesforce expect to lose a quarter of a billion dollars this year and they expect to lose over $100m in both of the next two quarters.

It seems, unfortunately, this quarter’s profit is an anomaly and not a paradigm shift in thinking that making a buck is a good thing.

Staff Numbers

The slowing growth of staff has been truly bucked this quarter, leaping up to 43% and back to the kind of growth Salesforce was seeing a year ago.

Earnings Call Buzzword Bingo

As with other quarter’s, here are the buzzword bingo figures.

| | 2013 Q1 | 2013 Q2 | 2013 Q3 | 2013 Q4 | 2014 Q1 | 2014 Q2 |

| Number of words | 3200 | 3200 | 3000 | 3800 | 2800 | 3500 |

| Revenue | 38 | 39 | 38 | 45 | 32 | 37 |

| Social | 32 | 21 | 13 | 9 | 10 | 9 |

| Cloud | 23 | 20 | 20 | 22 | 16 | 23 |

| Enterprise | 21 | 10 | 7 | 15 | 0 | 6 |

| Customers/Customer | 28 | 9 | 21 | 40 | 32 | 40 |

| Sales | 14 | 8 | 9 | 8 | 9 | 14 |

| Cash | 13 | 17 | 9 | 13 | 10 | 10 |

| Service | 11 | 15 | 9 | 16 | 12 | 14 |

| Growth | 11 | 19 | 17 | 17 | 13 | 12 |

| Operating | 10 | 17 | 0 | 0 | 9 | 9 |

| EPS | 8 | 0 | 0 | 0 | 7 | 10 |

| Marketing | 0 | 8 | 10 | 9 | 0 | 12 |

| Mobile | 0 | 0 | 7 | 0 | 16 | 11 |

| Margins | 0 | 0 | 0 | 7 | 0 | 1 |

| ExactTarget | 0 | 0 | 0 | 0 | 0 | 24 |

The key words are still consistent. ExactTarget got a good showing but it is their new acquisition so this is not too surprising.

Phrases of two or more words:

- Deferred revenue (15 times)

- Non GAAP (12 times)

which are the same as last quarter.

Insider and Institutional Sales

According to Yahoo, in the past six months, insiders did a net sale of 0.5% of their shares. This was made up of one purchase and 109 sales.

Institutions sold 16 million shares this quarter, reducing their overall ownership by 3%.

There are many reasons why people sell shares. Whether this is a dropping confidence or simply the desire to pay a few bills or diversify investments is difficult to say.

Google Trends

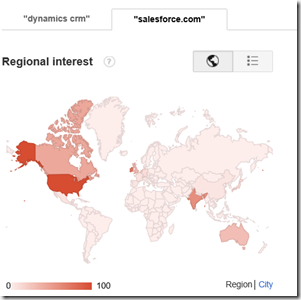

It has been a while since I have done the Google Trends analysis and I noticed a week or two ago that there are a bunch of new features so here is the Google Trend analysis for ‘salesforce.com’ and ‘dynamics crm’.

The dotted lines are Google’s predictions (no more Excel straight line extrapolations)

The regional comparison is also interesting.

We see a more global interest in Dynamics CRM and a more focussed interest in Salesforce. In Central and South America and in Europe it seems Dynamics CRM has the edge whereas Salesforce has a strong concentration in the USA.

I am not sure what is behind this trend but it will be interesting to monitor it over time.

Conclusions

While Salesforce has broken the drought and made a profit this quarter, there is no indication that the ship is changing direction. Marc’s appetite for revenue over profit continues. Similarly Marc’s messaging is also unwavering, focussing on the key words and phrases this quarter as the last.

Insiders continue to sell and it seems institutional owners of Salesforce shares are also reducing their holdings. Whether this is connected to Marc’s strategy is unknown.

Google trends suggests interest in both salesforce and Dynamics CRM is at similar levels but the global focus is different. While the Salesforce buzz is generated primarily out of the USA (San Francisco to be precise), Dynamics CRM buzz is much more global with USA not even appearing in the top ten countries and the highest ranking USA city being New York at the eighth position.