I came across this infographic from Capterra a little while ago and tweeted it. To be honest, the idea of using social with equal weighting to customers and users does not sit too well with me but what occurred to me was, using the ratio of users to customers, we could use this to estimate which product the big end of town use i.e. which is the most ‘enterprise’ CRM.

Clicking through to the Capterra website gives us their raw data. I have filtered the list here to those CRMs which appear on the latest Gartner Magic Quadrant.

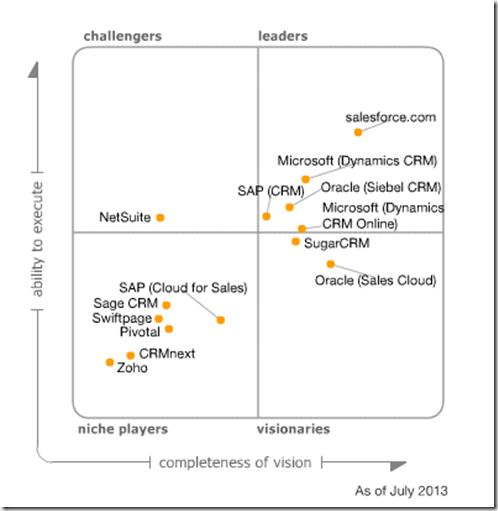

Obviously there are other CRM systems on the Magic Quadrant but they do not appear in the Capterra infographic (SAP, for example). If you have numbers for those that are missing, feel free to add them to the comments. Here is the quadrant for reference.

Checking the Numbers

Regular readers will know I keep track on subscription numbers for Microsoft and Salesforce, although Salesforce have not released user numbers for about two years. The last accurate numbers were in January 2011 when there were 3,000,000 users and 92,300 customers, giving us a ratio of around 33. For Microsoft, the ratio around the same time was 63 (1,700,000 users and 27,000 customers). Microsoft has edged this up to 77 in their latest numbers which came out in March this year (3,000,000 users and 39,000 customers).

For Oracle, the PDF source used by Capterra quotes 4,600,000 users and 4,000 enterprises, giving a huge ratio of 1,150. Given Siebel is the traditional enterprise CRM, this is probably right.

For Zoho, I struggle to believe the numbers are accurate. Zoho is a great little SFA solution, but it is limited, as highlighted in the Gartner Magic Quadrant. I assume they are counting the people who have signed up for the ‘free for the first three users’ version, and then counting the number of organisations who have signed up for a paid subscription. I signed up for the free subscription a few years ago but I do not consider myself a user of Zoho, even though the subscription is probably in the count.

The SugarCRM source checks out. While Capterra offer no source for their Sage numbers, this one claims 3,100,000 users for ‘Sage CRM solutions’ and 10,000 organisations for ‘Sage CRM’, giving us a ratio of 310, which is much larger than the one using the Capterra numbers. I assume it is accurate but I wonder whether this also includes the user numbers for Sage SalesLogix and Sage ACT!, explaining the disparity.

Therefore in modified numbers, we have:

- Oracle: about 1,000

- Sage CRM: 310 (or possibly 51, depending if Sage are spinning their numbers or not)

- Zoho: 220 (although I do not believe it)

- SugarCRM: 143

- Dynamics CRM: 77

- Salesforce: 33

Therefore, the big end of town appear to be using Siebel and, surprisingly, SugarCRM (possibly boosted by IBM switching to it from Siebel). If you believe the numbers, Sage CRM and Zoho are also up there but my spidey sense tingles on these ones. Next we have Dynamics CRM with Salesforce in last place.

Conclusions

Large organisations appear to be on Siebel over competitive offerings and so it maintains the title of the most enterprise CRM. Given the strong growth of Dynamics CRM and Salesforce I am wondering if they are taking market share from Oracle, which will boost their numbers in the long term. At the other end of the spectrum is Salesforce whose average customer has 33 users but may be increasing if they are taking market share from the larger players. In the middle are the others (Dynamics CRM, SugarCRM, Zoho and Sage CRM) whose customer size ranges from 50-300 users in size.