It’s that time of the year again when Santa Benioff delivers us another little present in the form of the quarterly results for Salesforce. I will do the financials (but not this week).

In the past I have tried to summarise what is becoming a dull financial transcript (dull in the sense the numbers are Non-GAAP and there is never reflection on what could be improved e.g. profitability, cost reduction etc.) So I thought I would try something different this time.

Using the historical quarterly update transcripts and an online text analyser we can see the top ten buzzwords in the pre-question monologues of Marc Benioff, CEO and Graham Smith, CFO. I have excluded the safe harbor and Dorothy Dixer questions from the analysts so specific topics raised by analysts do not skew the results. I have also applied my own filter to eliminate things like ‘the’ and ‘year’. Here I present the top 12 keywords. The reason for 12? This way you can put them on a 4x3 grid, grab a bottle of your favourite tipple and, with some mates, play the Salesforce Quarterly Results Drinking Game next quarter.

| This Quarter’s Keywords (total words: 3200) | Last Quarter’s Keywords (total words: 3200) | Last Year’s Keywords (total words: 4400) |

| revenue (39 times) | revenue (38 times) | social (42 times) |

| social (21 times) | social (32 times) | revenue (30 times) |

| cloud (20 times) | cloud (23 times) | customers (27 times) |

| growth (19 times) | enterprise (21 times) | enterprise (25 times) |

| cash (17 times) | customers (17 times) | cloud (25 times) |

| operating (17 times) | sales (14 times) | growth (21 times) |

| service (15 times) | cash (13 times) | cash (15 times) |

| enterprise (10 times) | service (11 times) | sales (13 times) |

| customers (9 times) | customer (11 times) | dreamforce (13 times) |

| dreamforce (9 times) | growth (11 times) | customer (12 times) |

| marketing (8 times) | operating (10 times) | radian6 (12 times) |

| sales (8 times) | eps (8 times) | service (10 times) |

Key phrases (two words or more) for this quarter included:

- ‘cash flow’ (mentioned fifteen times)

- ‘deferred revenue’ (mentioned ten times)

- ‘operating cash’ (mentioned eight times)

- ‘revenue growth’ mentioned eight times)

- ‘revenue run rate’ (mentioned seven times)

- ‘acquisition of Buddy Media’ (mentioned four times)

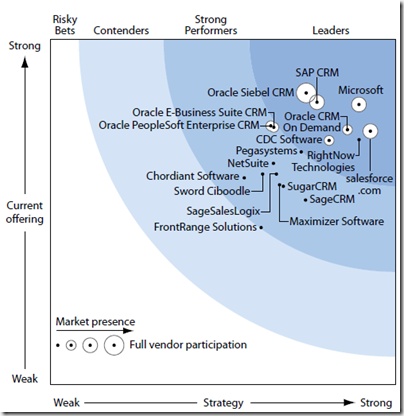

- ‘the undisputed leader in Gartner’s magic quadrant’ (mentioned twice, Forrester was not mentioned funnily enough)

New Topics At the Front of Mind

Obviously cash flow and revenue are the key measures being promoted (which is nothing new really). The recent purchase of Buddy Media rated a mention along with hints of something brewing in combination with Radian6 (maybe we will see something more at Dreamforce). The Gartner results were also pushed a little given Gartner strongly believes in the social vision of Salesforce.

Topics in Decline

- Social: mentions of social have halved from a year ago, which surprised me. I am wondering if this is a result of the recent #notinourname campaign of Australian and UK not-for-profit organisations which take exception to Salesforce attempting to trademark the term ‘Social Enterprise’.

- Customers: Marc prefers to cite specific examples of big deals these days which may account for ‘customers’ dropping so significantly in their mentions as a whole. This begs the question whether Salesforce is now focussed on the big deals rather than all customers though.

- Enterprise: The other half of the phrase ‘social enterprise’, this has also dropped. In fact, the term ‘social enterprise’ has gone from 20 mentions a year ago to less than a third at six mentions today.

- Mentions of the ‘cloud’ has also reduced but not as much as some of his other key phrases.

The big surprise here for me is the downplay of the ‘social enterprise’ compared to last year. As far as I know, this is still key to the Salesforce strategy and yet it is not being driven home as strongly as it once was.

Topics on the Rise

- Revenue: Not a huge increase, but an increase anyway. A cynic would suggest they are shouting about revenue to distract from the lack of profits for five quarters in a row. I just think they are talking up the one statistic which makes them look healthy.

- Service: Most of the mentions of ‘Service’ refer to their Service Cloud offering. I am wondering if something is on the horizon with their service products at the upcoming Dreamforce

Conclusions

From reviewing the transcripts, it seems to me there is a lot to be seen at Dreamforce. There are the possibilities of a marketing and a service product vision (as well as an HR one which is getting a lot of air time at the moment) which is very exciting.

The phrase ‘social enterprise’ appears to be on the decline, which I still cannot fully explain. Is there something new on the horizon for Marc to sell a vision for?

While this could be argued as taking the data too far, there is a reduced focus on ‘customers’ and therefore, potentially, a reduced focus on customers in general. In the past, Salesforce was proud of its efforts to ensure all companies of all sizes could access the Salesforce products and they proudly advertised the fact. The days, all we hear is ‘Salesforce + <company> = Like’ and the Social Enterprise License Agreement.

Revenue mentions have increased and are likely to continue to dominate the mention tables. Revenue growth looks good (hopefully profits will soon as well) so it makes sense to talk it up.

In conclusion it is fair to say the keywords paint a picture of an organisation at an inflexion point with new products coming soon and old ideas fading as their usefulness dwindles. Similarly they paint a picture of an organisation at an inflexion point in terms of the kinds of customers they pursue. Do they go after the big deals with big household names? Or do they go after smaller deals, as in the past?

The one conclusion that comes through loud and clear is that it is all about revenue and growth and not about profits and sustainability. When I have raised this with Salesforce employees in the past, the answer is always ‘we are pursuing a growth strategy’. I will respond to my thoughts on that when I review the financials in an upcoming blog article.