My blog this week is prompted by a claim I saw in a private group. The author, Jason Carter, suggested that, effectively, Sage had done nothing to grow the ACT! and SalesLogix businesses since acquiring the products about ten years ago. This sounded incredulous so I thought I would look at the numbers.

Interact Commerce in the Year 2000

Interact had two flagship products: ACT! (a contact management solution) and its big brother SalesLogix (a small to medium-sized CRM solution). The dot-com bubble was about to burst (http://en.wikipedia.org/wiki/Dot-com_bubble) and a review of their annual report at the time confirms things were troubled. For those of you that want to comb through the details, here is the link (http://www.sec.gov/Archives/edgar/data/1027108/000095015301500160/p64748e10-k.htm). Here are some of the highlights:

- Revenues: $108m (2000), $36m (1999), $16m (1998)

- Total Operating Expenses: $126m (2000), $35m (1999), $18m (1998)

- Net Loss: $57m (2000), $8m (1999), $7m (1998)

- Cash used in operating activities: $17m (2000), $3m (1999), $5m (1998)

- Research and Development: $25m (2000), $7m (1999), $4m (1998) (let’s say about 20-25% of revenue)

In 1999 and 1998 Interact had issued stock and borrowed money to keep the cash flowing in. In 2000 they did not do this and burned through $49m in cash.

So while revenues were indeed increasing at an incredible rate (two-fold between 1998 and 1999 and three-fold between 1999 and 2000), operating expenses were in lock-step and profits were nowhere to be seen. Similarly, the business was failing to generate cash from sales and was propping things up through shares and debt.

Sage in the Year 2010

Sage acquired Interact Commerce in 2001. Along with the acquisition of ACCPAC CRM in 2004, ACT! and SalesLogix make up the stable of CRM offerings in the Sage product mix.

Reviewing Sage’s latest annual report we discover that 4% of Sage’s revenue came from their CRM products (http://ar2010.sage.com/whatwedo.asp)

Diving into the numbers (http://ar2010.sage.com/Consolidated-income-statement.asp) we discover that the revenue for 2010 was 1,435.0 million pounds. Taking an exchange rate of 1.6 pounds to one US dollar (the rate around the end of 2010), this translates to around $2,300m in total revenue. 4% of this is about $92m.

So the revenue for the CRM products has gone from around $110m to $90m in ten years i.e. it has not changed significantly and may have actually shrunk. Also note this also includes the, assumed, additional profits of Sage CRM (ACCPAC CRM).

The big difference in the two financial reports is in their health. Although the Sage annual report only talks about the business as a whole, not just the CRM component, Sage is profitable and generating healthy cash flows i.e. they are generating cash from their operations.

Research has also suffered in the name of a healthier bottom line. According to the full annual report, Sage spent a total of 158.9 million pounds on research and development. This is around 11% of revenue, about half what Interact felt they had to invest, as a percentage of revenue, to stay on top.

The Current Popularity of Sage’s CRM products

Back in July of last year, I used Google Trends to see how Dynamics CRM is travelling relative to Salesforce (http://leontribe.blogspot.com/2010/07/using-google-trends-to-predict-crm.html). As an aside, if you want to see an up to date and expanded version of my Salesforce vs Dynamics CRM blog, I will be presenting precisely this at the upcoming Decisions Spring 2011 (http://decisions.msdynamicsworld.com/session/microsoft-dynamics-crm-vs-salesforce-main-event).

We can now use the same technique to review the popularity of the Sage suite of products relative to, say Dynamics CRM.

Using Dynamics CRM as a comparison, it is clear that the Sage CRM products are not generating as much interest as Dynamics CRM. Also, it is amazing how far ACT! has dropped since seven years ago.

Conclusions

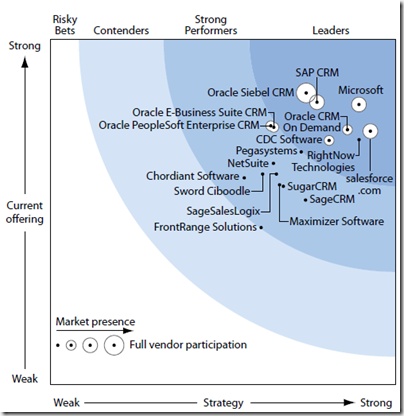

Sage has not grown their CRM business and has remained effectively stagnant for the last ten years. Moreover, they have cut back research dollars, relative to revenue. In its time, SalesLogix was at the top of the mid-market CRM players. So much so that when Dynamics CRM was first released, the ROI tools provided to Microsoft partners mentioned only two CRM products: Dynamics CRM and SalesLogix. Back in 2003-2004, SalesLogix was to Dynamics CRM what salesforce.com is today.

What is not clear is whether Sage’s stagnation is due to transforming the financials to health or plain old neglect. Either way, products such as Dynamics CRM have now taken the place in people’s minds when they think of CRM and, given the lack of investment in research it is difficult to see how Sage can recover from this position to regain former glory.