Here is the Salesforce drinking game I play when listening to the quarterly transcripts (because even I have to make it a little more interesting). You pour a drink every time they mention Non-GAAP. You get to take away a drink if they mention GAAP.

I currently have 12 drams of one of Scotland’s more affordable single malts in front of me thanks to the drinking game. Every quarterly review from now on I will report the ‘dram count’ for the report. Given this may run my whisky supplies dry, I am open to sponsorship by whisky makers or bottle donations (come on Marc, I know you are good for it). All contributions welcome.

Why is Non-GAAP so important to the quarterly reports? Because it allows Salesforce to turn their persistent losses into a mythical profit. If they applied the same accounting treatment to their carbon emissions, they could claim that every time you use Salesforce, a glacier grows.

I fully expect to detox when Salesforce turn a profit because all of their reporting will transform into GAAP numbers. Until then, here is mud in your eye.

Numbers of Note

Normally I post the big table of numbers. I will still use the big table of numbers but it strikes me you are probably more interested in the insights than the data so I will still be using the same numbers, just not filling up the blog with the table. For those new to the game, I take my numbers from Salesforce’s own website but rather than use the ‘creative’ numbers of their press releases, I use the ones they report to the SEC because you get in trouble if they are wrong.

Profitability

In the last two quarters, Salesforce was heading in the right direction. A rental adjustment meant a tiny profit was turned in quarter one and the loss was not huge in quarter two but, unfortunately Salesforce are back to their usual form this quarter with a $25m loss. Compared to the losses of the past (Salesforce lost a little over a quarter of a billion dollars last financial year) it is not huge but still, it is not a profit.

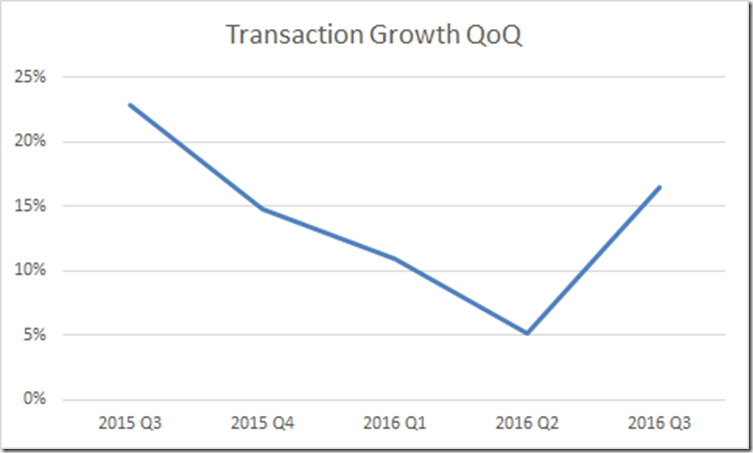

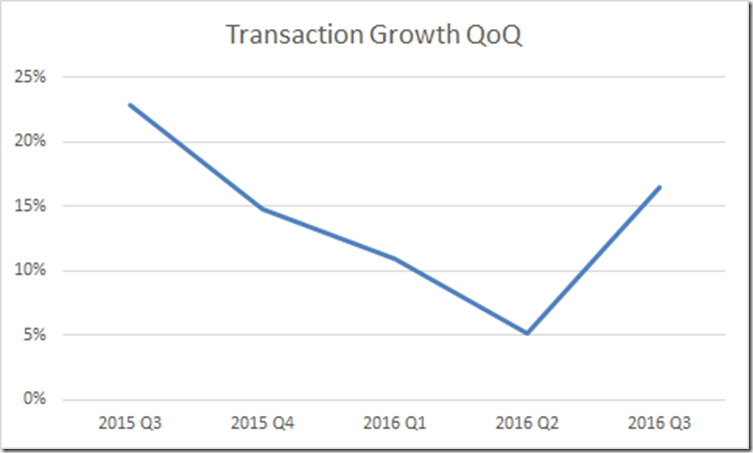

Transaction Growth

I predicted last quarter that transactions would go flat. Fortunately, for Salesforce, I was wrong.

Transaction growth, which had been steadily falling, had an uptick this quarter, back to 16% growth.

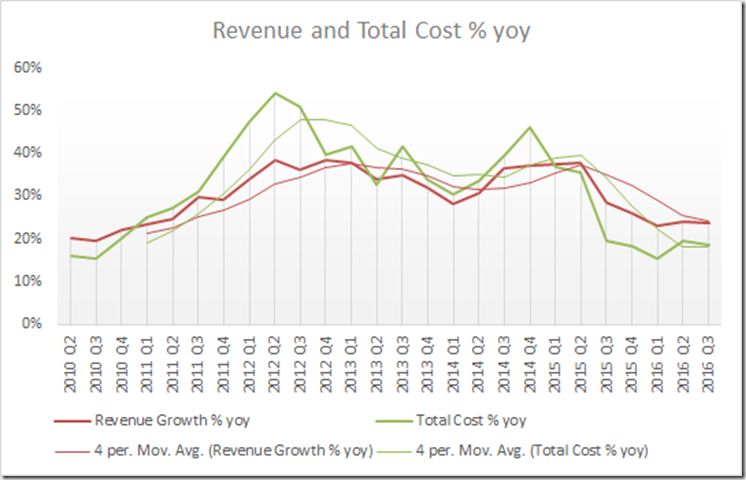

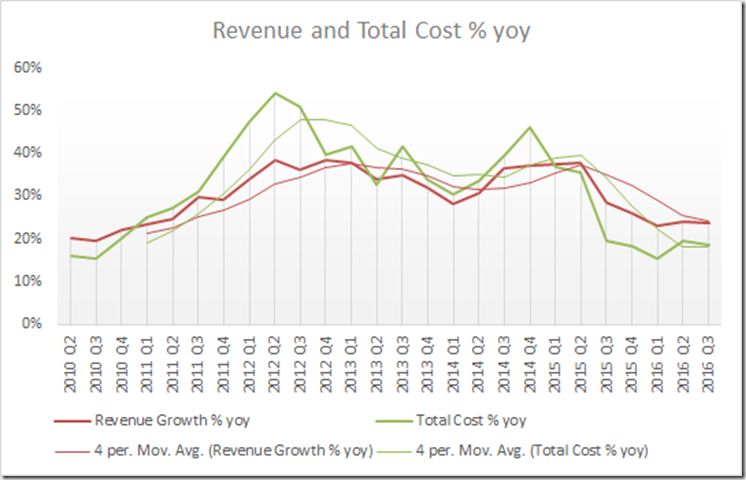

Revenue and Cost Growth

The year on year revenue and cost growth tell a story about Salesforce’s history and gives insight on where they are heading.

If we look at where the solid green and red lines cross, we see three periods in the history of Salesforce.

The Sensible Years (before 2011 Q1 i.e. before 2010)

Before 2011 Q1, that is 2010, revenue growth was on top. The business flourished combining high revenue growth with increasing profits and market share. Accounting did not have to be creative and the business could do no wrong. Here is the transcript from 2010 Q4 where, not surprisingly, reporting was in GAAP numbers. This changed, and in 2011 Q2, we had a mix of GAAP and Non-GAAP reporting and we finally transitioned to full Non-GAAP reporting in 2011 Q4, just prior to the losses appearing.

The Aggressive Years (2011 Q1 to 2015 Q1 i.e. between 2010 and 2014)

This is when marketing and sales costs grew faster than revenues, thus the creative accounting. The official line is the strategy ensured aggressive market share growth. My interpretation is the executive, being compensated in shares, wanted to maintain the share price while they offloaded their holdings (the executive have consistently sold their shares in Salesforce despite their optimism for the company). With the market fixated on revenue growth, the decision was made to sacrifice profit to ensure revenues continued to go through the roof. Non-GAAP reporting helped hide the losses which resulted.

Interestingly, Salesforce only started making a loss a year into this period (just after the switch to Non-GAAP reporting) so if you wanted to predict when Salesforce would go into the red, the growth chart above predicted it a year in advance. For Salesforce, revenue and cost growth is an excellent leading indicator.

The Buyout Years (2015 Q1 to the present i.e. 2014 onwards)

Since 2014, Salesforce has focussed on getting marketing and sales spend under control and they are doing a pretty good job of it. The last couple of quarters, the growth difference has been a consistent 5%. If revenue and cost growth is a leading indicator, this suggests profitability in the near future.

As suggested in my labelling of this period, and influenced by recent events, I see this as the executive getting the books in order for a buyout.

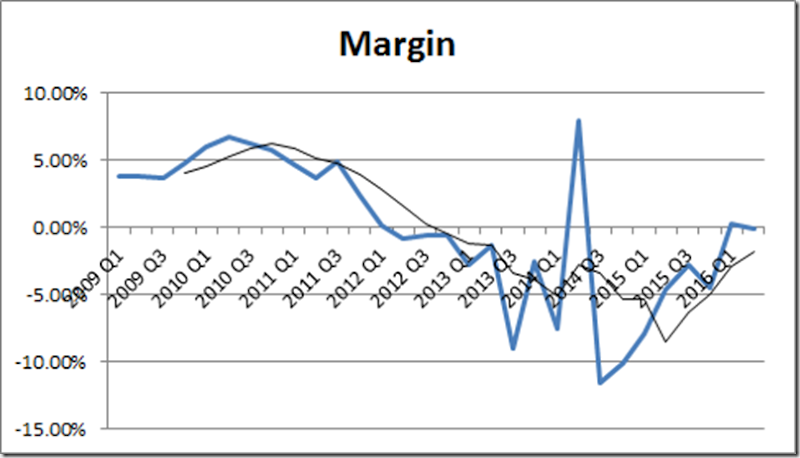

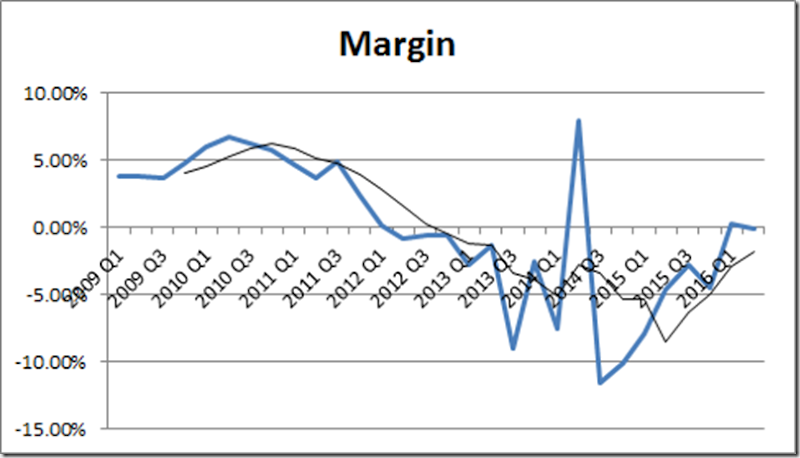

The idea of a return to profitability is also backed up by the margin graph.

While the solid blue line is all over the shop, the four-period trend line is heading upwards towards the positive.

Earnings Call Buzzword Bingo

Here is the list of words mentioned 10 or more time in the last five quarters

| | 2015 Q3 | 2015 Q4 | 2016 Q1 | 2016 Q2 | 2016 Q3 |

| Number of words | 3922 | 4017 | 3495 | 4175 | 5147 |

| Customers/Customer | 34 | 23 | 34 | 42 | 41 |

| Revenue | 26 | 25 | 24 | 18 | 16 |

| Cloud | 47 | 32 | 28 | 20 | 18 |

| Platform(s) | 27 | 18 | 14 | 16 | 13 |

| Service | 12 | 5 | 9 | 13 | 4 |

| Growth | 16 | 13 | 16 | 17 | 21 |

| Cash | 9 | 10 | 11 | 11 | 8 |

| Operating | 8 | 20 | 11 | 13 | 8 |

| Dreamforce | 14 | 2 | 1 | 21 | 7 |

| Analytics | 14 | 11 | 9 | 4 | 1 |

| Software | | 12 | 4 | 9 | 10 |

Sadly we lost ‘Marketing’ and ‘Enterprise(s)’ which seem to no longer be a focus. I have heard mixed reports on the success of the ExactTarget acquisition which may explain why Marc is moving away from talking about it. In terms why ‘enterprise’ is on the nose, I assume Salesforce is no longer bringing in the big deals they used to brag about so much.

As for other trends in the words, ‘Revenue’ mentions are steadily declining as the business slows down. Talk of the cloud and Salesforce as a platform is also diminishing. Marc says the literally hundreds of CEOs he talked to in the quarter do not care about the cloud, but about their customers so maybe this is to blame. This being said, one of the key selling points of the past was the Force platform so to move away from this is curious.

Google Trends

I am dropping the Google trends from the quarterly report. Dynamic CRM has won the Google search war and is the more international product. To replace it, I am adding the ‘Truth in Transcripts’ section below.

Insider and Institutional Sales

It is a Black Friday sale for the shares of Salesforce.

| | 2015 Q3 | 2015 Q4 | 2016 Q1 | 2016 Q2 | 2016 Q3 |

| Insider Sales | 4.70% | 4.60% | 4.50% | 4.40% | 4.90% |

| Institutional Sales | 3.20% | 3.11% | 3.04% | 3% | 5.87% |

As I predicted last quarter, the insiders (such as the board) have increased their selling and the institutions are also selling out, going from selling 3% of their holdings to almost 6%. The insiders are getting nervous? Do they think the price of the shares is about to crash?

Looking to the Future

I predicted Salesforce would break even but they made a 25 million dollar loss so no joy there. In terms of revenues, I was 4% off which is not too bad. Next quarter I predict $1.8b in revenue and another $25m loss.

Truth in Transcripts

My new section where I examine the claims made in the quarterly transcript and challenge them in reference to the GAAP numbers reported to the SEC. All quotes taken from the Seeking Alpha transcript.

Here are the creative claims this quarter:

“And of course, Salesforce, as you can see will be the fourth largest software company in the world next year, but you can see that we'll be one of the only software companies ever to reach $10 billion in revenue.” – Marc Benioff

I think this was a genuine mistake by Marc. I think he meant to say “…$10 billion in revenue within <x> years”. Microsoft alone pulls in over $20b a quarter in revenue so the statement is clearly wrong.

“…we also delivered…margin improvement” – Marc Benioff

In Non-GAAP terms perhaps. In GAAP terms, margins fell 1.4%. As shown above though, the longer term trend suggests things may improve in the future.

“…we are also deeply committed to continuing to increase our profitability, and the results this year are evidence of that.” – Marc Benioff

“From a bottomline perspective, we delivered another quarter of improving profitability.” – Mark Hawkins

GAAP margins have gone down each quarter this financial year as have profits with the last two quarters showing a loss. The long term trend is positive but this quarter, and the previous one were not great for margin improvement.

So the misdirection is mostly around profitability. Clearly this is the chink in the Salesforce armour. It is really difficult for them to make as much noise as they do through marketing and make a profit.

Conclusions

Salesforce continues to struggle with making the business profitable and, while things have improved compared to the aggressive years, the executive are still wrestling to stabilise the business. If they can keep revenue growth above cost growth they should be ok but it is clearly hard for them to keep costs under control. As usual, I look forward to the next quarter to see if management solve the riddle of making a profit or whether they will continue to keep me drinking, stick with the Non-GAAP fairytales and pretend the ship is in calm waters, rather than admitting it is heading for an iceberg.